Black Myth: Wukong is not only an incredible success on launch, but exemplifies the shifting attitudes towards AAA gaming. Game Science’s action title is the most recent in a wave of high-quality Chinese games coming from smaller studios that dazzle audiences with their polish and cohesion. Writing for Polygon back in 2022, Khee Hoon Chan termed this phenomenon “the rise of prestige Chinese games”, and the trend they observed seems to have continued.

However, while players are flocking to these titles, the same conclusion hasn’t as yet been drawn about prestige Chinese games on live streaming. In this article, we’re looking at how the success of Black Myth: Wukong has translated onto live-streaming platforms, and whether the most successful titles from this new wave of prestige Chinese gaming are also capturing the attention of viewers online.

Black Myth: Wukong’s Complex Combat and Souls-like Comparisons Drum Up Viewership

For the uninitiated, Black Myth: Wukong is a boss rush-style action game in which the player adopts the persona of Sun Wukong: A shapeshifting monkey of incredible power determined to battle the gods. The game has mostly been compared to the Souls series, with a bend towards the more flowing, less-punishing combat of God of War Ragnarök. The game was much hyped thanks to a high-quality gameplay trailer in August of 2020 that had 10M views as of the game’s release.

This hype paid off: Black Myth: Wukong generated 32.3M hours watched in its debut week, with a combined airtime of 766K hours from the many, MANY channels covering the game. In fact, the game’s launch day viewership of 8.4M hours watched is the second highest of any game released in the past five years (only beaten by Hogwarts Legacy). Such results might have been expected, given that Black Myth: Wukong sold 10M copies just 3 days after launch, and had 2.2M players on the first day.

Part of the game’s success on live streaming results from its Souls-like status, making it a drawcard for fans of Elden Ring and its DLC that was released earlier this year. But Black Myth: Wukong is significantly different from Souls-likes, and so the marketing boost from this comparison is really a matter of clever positioning by the game’s promotional team. Black Myth: Wukong does share many traits that make Souls-likes enjoyable to watch however: The game is difficult, graphically impressive, and contains mechanics that are purposely underexplained to force player experimentation. This experimentation pulls viewers online to discover the best tips and tricks from skilled streamers.

Black Myth: Wukong’s Top Streamers Have Global Reach Far Beyond China

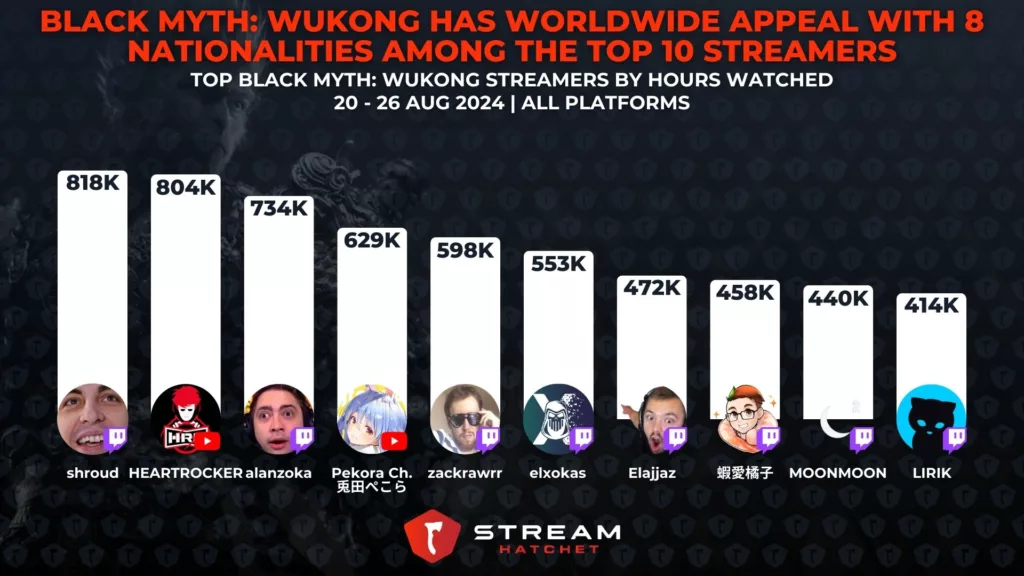

Some online pundits point out that much of Black Myth: Wukong’s player base is in its home country of China. However, the same is not true of the game’s live-streaming audience. Among the top 10 most watched Black Myth: Wukong streamers, 8 different countries are represented, with Canadian streamer Shroud taking the top spot at 818K hours watched. In fact, only one Chinese-speaking streamer made the top 10: 蝦愛橘子 (shuteye orange) with 458K hours watched.

Naturally, much of this Western reach is again owed to the game’s Souls-like comparisons. Given the massive success of Kai Cenat’s Elden Ring marathon streams, creators were inclined to jump on the Black Myth: Wukong hype train early this time around. The game also draws on Chinese mythology but without using excessive exposition that might alienate Western players. Other Asian markets were also well-represented among the top 10 streamers, with Usada Pekora (Japanese) and HEARTROCKER (Thai) bringing in 629K and 804K hours watched, respectively.

Black Myth: Wukong is One of Many Recent Prestige Chinese Games Making a Splash on Live Streaming

Game Science’s success in shifting from mobile games to AAA projects with Black Myth: Wukong represents a broader trend in the Chinese game industry. Historically, Chinese developers mostly created mobile games due to the Chinese government’s bans on consoles from other countries. When these bans were lifted in 2014, Chinese game studios who had cut their teeth working on international titles grew more ambitious and sought to create their own AAA titles. Around 2020, these efforts paid off with a number of prestige Chinese games finding success not just locally, but overseas.

The first wave of these titles were Gacha games, and this success translated directly onto live streaming. The most watched prestige Chinese game on live streaming by far is Genshin Impact, with an aggregated peak viewership of 1.6M concurrent users – in other words, the peak viewerships for each respective platform combined together. Other gacha games like Zenless Zone Zero and Wuthering Waves also saw success on live-streaming platforms with peak viewerships of 271K and 205K, respectively.

Black Myth: Wukong still stands out with an impressive peak viewership of 737K – around 500K higher than other well-performing prestige Chinese games. Outside of Gacha games, there’s also FPS title Arena Breakout: Infinite and simulation game Dyson Sphere Program proving how Chinese developers are capable of producing some of the highest-quality titles in these game genres. No doubt when Netease’s Marvel Rivals releases later this year, it will bring that same polish to the hero shooter genre.

While it’s tempting to jump on the hype train for prestige Chinese gaming on live streaming, it’s important to keep things in perspective. In the past 12 months, just 7.8% of all live-streaming viewership came from games either developed or published in China. While this is an impressive fraction, it doesn’t match up to the performance of countries producing mega-popular RPGs, MOBAs, Shooters, and Battle Royales.

This will change, however. Support for early venture game investments in China is greater than in every other region combined. Tencent in particular is supporting early stage studios through its Venture Lab initiative. These moves look to nurture new, exciting gaming opportunities in China that will innovate video game design and bring their ideas to a worldwide audience. This is a big deal, reversing China’s game industry’s increasing dependence on domestic revenue (which increased from 48% to 78% over 20 years). As China invests into gaming, more high quality titles like Black Myth: Wukong will capture international attention on live streaming.

For Black Myth: Wukong specifically, however, viewership will most likely die off quite quickly as the game lacks a high amount of replayability. New DLC will be required to bring viewers back to live-streaming platforms after the bulk of the player base has beaten the main campaign. Until then, there are plenty of other upcoming prestige Chinese games for online audiences to dive into, including Phantom Blade Zero and Where Winds Meet. Stream Hatchet will watch their performance when the games release later this year.

To keep up to date with the latest big game launches on live-streaming platforms, follow Stream Hatchet: