Significant shifts in South Korea as Twitch, the Amazon-owned live-streaming platform, prepares to shutdown its services by February 2024.

This decision, influenced by prohibitively high network costs and regulatory challenges, brings into focus the impact on Korean streamers and the emergent opportunities for local streaming platforms.

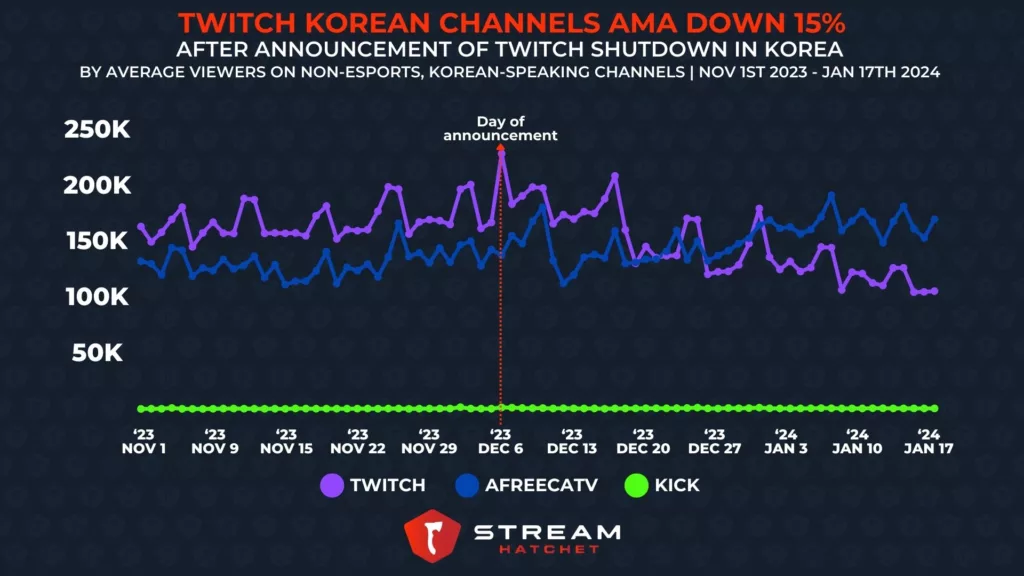

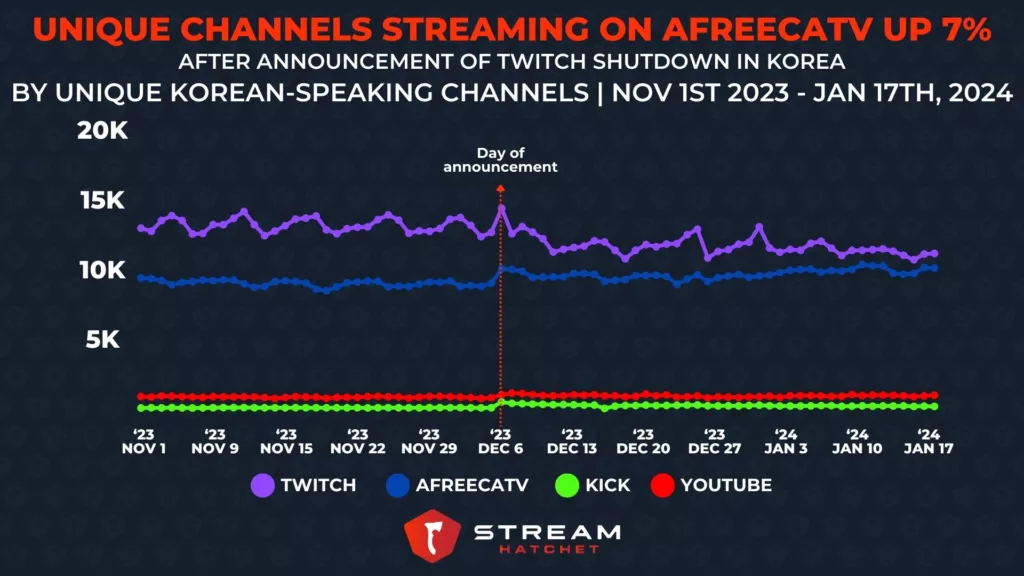

In the first six weeks after the announcement, changes in viewer and creator behaviour can already be seen across Twitch and AfreecaTV, as well as Kick and YouTube.

Analysis of Streaming Data from non-esports, Korean-speaking channels (November 1st, 2023–January 17th, 2024)

Average Minutes Watched (AMA) Before and After Twitch’s Announcement:

- Twitch: AMA decreased from 134,463 to 116,476, a drop of 15.44%.

- AfreecaTV: AMA rose from 104,714 to 122,103, an increase of 14.24%.

- Kick: AMA increased from 357 to approximately 600, a surge of 40.41%.

Average Unique Korean-Speaking Channels:

- Twitch: Unique channels reduced from 13,153 to 11,657, a 12.84% decrease.

- AfreecaTV: Unique channels grew from 9,008 to 9,675, a 6.90% increase.

- Kick: Unique channels saw a substantial rise from 97 to 256, indicating a 61.95% increase.

- YouTube: Unique channels increased from 861 to 953, up by 9.61%.

Korean Twitch Creators Moving to AfreecaTV and Other Platforms

Declining AMA and unique channels in Twitch suggests that audiences and streamers are looking for alternatives once the shutdown happens in South Korea.

AfreecaTV seems to be the top choice so far, since it is the go-to platform for Korean-speaking audiences. Since the number of unique channels streaming on the platform is growing, streamers seem to be testing the waters for alternatives already before the shutdown.

Korean creators also seem to be testing Kick and YouTube as other alternatives to Twitch in the region, based on increases in their AMA and number of unique channels.

Strategic Responses from Local Platforms

Twitch’s withdrawal has created opportunities for other platforms in the South Korean streaming industry. The competition is particularly intense between AfreecaTV and Naver’s new streaming service, Chzzk. Both platforms are looking to attract Twitch’s former user base and create solid audiences that will allow them to compete globally. Some strategies include AfreecaTV full on rebranding to SOOP and Naver’s Chzzk showcasing higher video quality and integrated services.

Twitch’s departure from the South Korean market signals a pivotal change, creating opportunities for local platforms and reshaping the streaming landscape. The rise of platforms like Kick and the steady growth of AfreecaTV, coupled with strategic moves by Naver’s Chzzk and the supportive role of NPE, highlight the dynamic nature of the Korean streaming market. Stakeholders and content creators must adapt to these changes to leverage new opportunities and sustain their presence in this evolving digital space.

Sign up to our newsletter if you want to stay on top of this shut down and what are the ramifications of this issue.