Every couple of months or so, an indie game randomly breaks out from among the dozens of games released on Steam every day to raucous live-streaming support. In March, Schedule I was that game: An edgy drug-dealing simulator that blends the economics of Supermarket Simulator with the criminal antics of GTA V. Streamers and viewers alike looked past Schedule I’s low production value and found the bud of an engaging new strain of game.

But games with risqué content launch all the time: Why did Schedule I score high while so many other games with sensitive content get stubbed out on the concrete? To find out, we’re taking a look at the success of the game upon its first release and backing up our theories with some data from our recent Q1 2025 report which was released last week (check it out if you missed it!)

Schedule I’s Rise To A Massive Peak Viewership

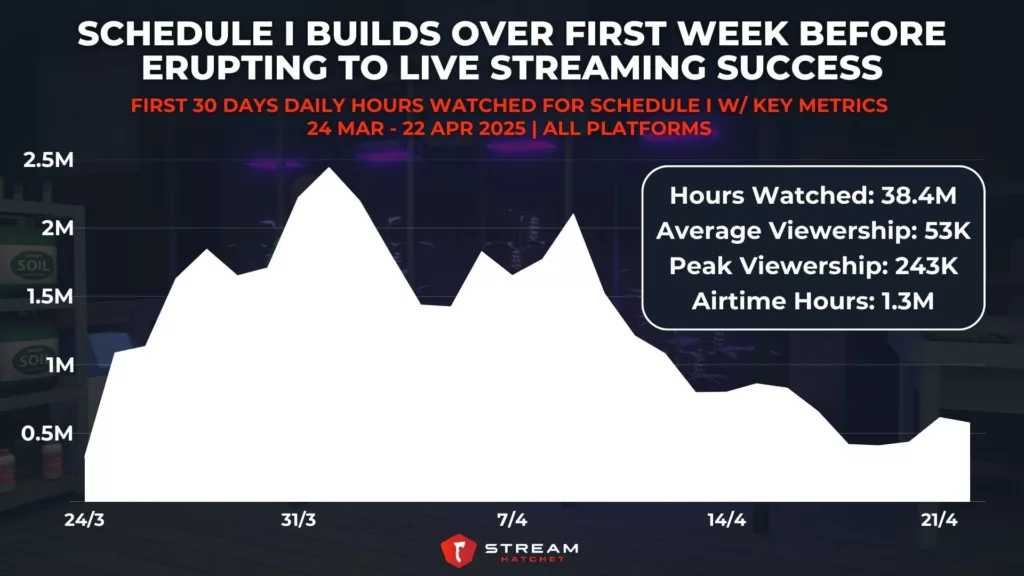

Schedule I had a delayed build-up to its peak performance. While on the first day Schedule I brought in 319K hours watched (a respectable number), it wasn’t ‘til 8 days later that the game hit its peak daily watch time of 2.4M hours watched (with a peak viewership of 243K). Impressively, the game even managed to stay above the 500K daily hours watched mark for almost the full 30 days – a sure sign of a game that keeps streamers coming back.

In total, the game saw two distinct waves of interest a week apart as word of the indie game’s quality spread throughout the live-streaming community – a very different viewership pattern than most AAA releases, which typically spike high at the beginning and then gradually taper off (until new content is released). While there are plenty of other Simulator games out there, players praised Schedule I’s ability to realistically promote the player up the drug dealing chain of command from street dealer to distributor, an impressively compelling gameplay loop despite the game still being in early access.

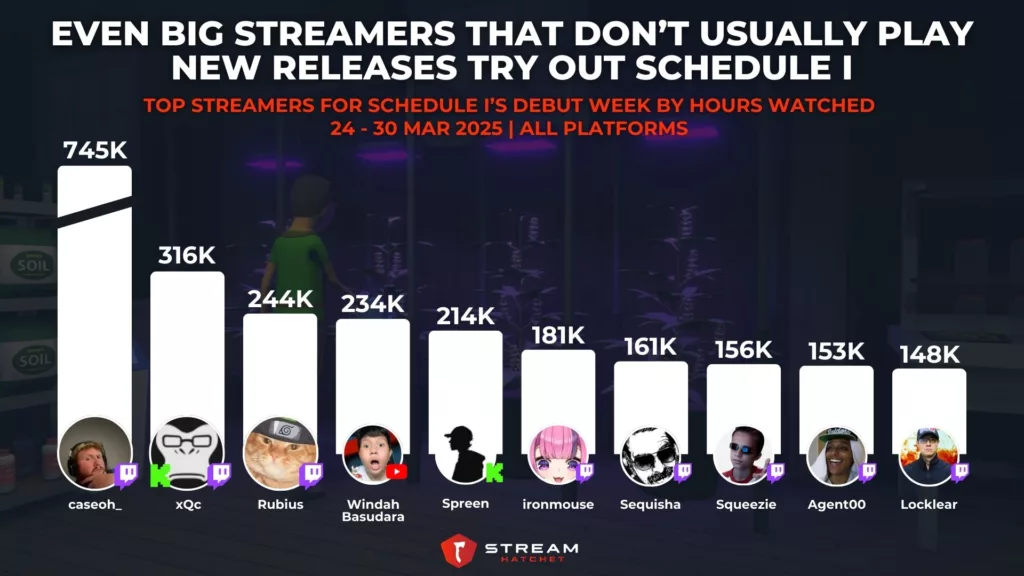

Focusing in on just the first week for a moment, we get our first insight into what made Schedule I pop off. The top streamer of Schedule I by far was caseoh_, with 745K hours watched – double that of second place xQc with 316K hours watched. These are some big hitters in the live-streaming world, bringing the game to public awareness. However, what’s more impressive is that Schedule I attracted big streamers other than the ones who typically try out new AAA games (people like zackrawrr and PirateSoftware). That includes Indonesian YouTube Gaming streamer Windah Basudara and Argentinian Kick streamer Spreen, also showing the global appeal of the title.

Schedule I Gets a Shoutout from The Top 100 Streamers

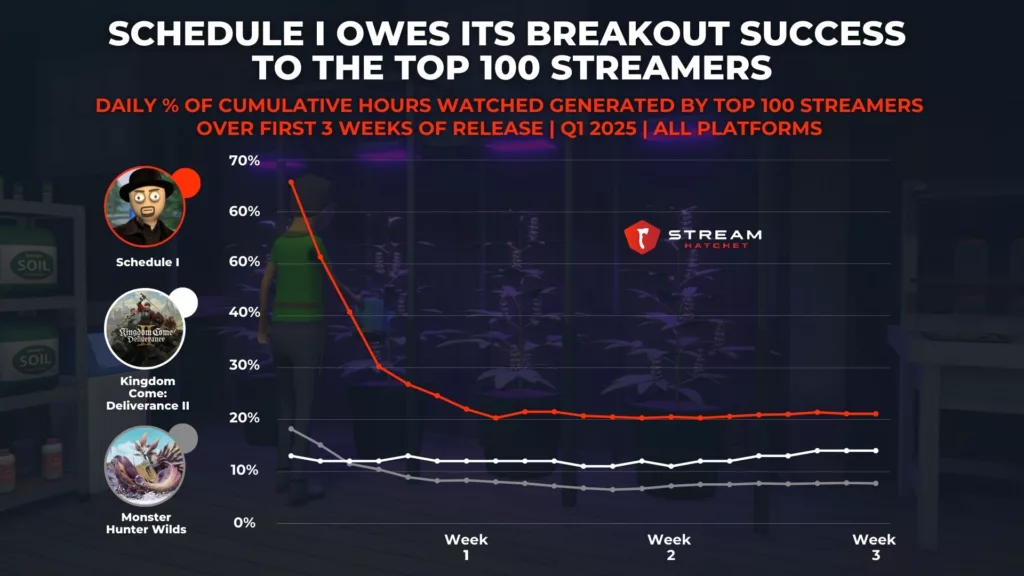

When we talk about “big-name streamers”, it can be a fairly ambiguous term. For the purposes of our discussion here, we’re going to see how just the Top 100 streamers impacted Schedule I’s performance – something we’ve looked at more closely in our Q1 2025 Report. Within its first three weeks of release, Schedule I was streamed by 20 of Q1 2025’s Top 100 streamers, including Caedrel, zackrawrr & KaiCenat. That led to a huge 65.7% of the game’s total hours watched coming from Top 100 streamers on the first day – a massive share for a game with no pre-existing IP.

Comparing this to sequels like Monster Hunter Wilds and Kingdom Come: Deliverance 2, we see that those games had much lower contributions from the Top 100 streamers on initial launch, and even a few weeks later still rested at half the cumulative hours watched of Schedule I. To drive this point home, consider that, in the 7 days prior to its release, Schedule I was mentioned in chats in only 2.5K Twitch channels while Monster Hunter Wilds appeared in chats across 12.2K channels (5X the attention). In other words, the sudden rise in demand post-release was helped by top creators expanding the reach of Schedule I.

Big-name Streamers Still Key to Indie Game Success

In our recent game marketing article, we looked at how viewership from the Top 100 streamers relates to a game’s total hours watched. This is particularly important for indie games, which historically have relied upon finding passionate advocates among big-name streamers to boost the profile of their titles. Let’s see how Schedule I fits into that previous analysis.

As seen before, there’s a strong correlation between the hours watched from Top 100 streamers and total hours watched. This makes sense since the former metric adds to the latter metric, but there’s also likely a copycat effect here whereby smaller streamers see bigger streamers covering these games and want to hop on the trend. Of the 20 games examined, just 9 were played by Top 100 streamers, but these 9 games outperformed nearly every other game in the sample (we’ll cover those in a moment). Schedule I had close to 10M hours watched from Top 100 streamers, putting it about 8M ahead of the next highest R.E.P.O., and this seemed to pay off as Schedule I also had the highest total hours watched (though, admittedly, by a much smaller margin). It may be that, past a certain point, the impact of those Top 100 streamers is diluted, having already generated peak interest in the game.

Among the 11 games not played by the Top 100 streamers, however, there’s still significant variation in success. 3 of the non-Top 100 games competed with the previous grouping (Lost Records: Bloom & Rage, Ender Magnolia: Bloom in the Mist, and Everhood 2), and the top game in this grouping (Lost Records: Bloom & Rage) had viewership 2 magnitudes higher than the lowest game in this grouping (Spirit Swap). It seems, then, that hitting those big streamers certainly isn’t a necessity for success, but phenomenal success for original IP requires their attention (e.g. Schedule I, R.E.P.O., Blue Prince).

_

In a world where AAA game budgets are getting exorbitantly expensive, it must be frustrating for big studios to see how a low-production value game with solid gameplay can still break through the noise of the Steam marketplace. Part of Schedule I’s success was no doubt its mature theming: Indies can go where the big studios can’t (or won’t) for fear of losing sponsors (with games like GTA V being notable exceptions due to their series legacy). Future indie games could learn from this, exploring avenues inaccessible to larger studios by tackling somewhat controversial topics.

To read more about recent games that popped off and related industry trends, download Stream Hatchet’s full Q1 2025 report now: