As a leading world economic power, China has the capital to drive innovation in the creative fields. Chinese game publishers have historically tuned their creativity towards massive AAA offerings and globally competitive esports-friendly titles.

However, in December of 2023 the Chinese government proposed new strictures designed to curtail gaming addiction. Among these, regulators aimed to clamp down on in-game spending, daily rewards, and loot boxes: Mechanics that are integral to many F2P and massively multiplayer games. In light of this news, Chinese publishers scrambled to adapt whilst remaining competitive with international companies. Thankfully for publishers, these proposals were withdrawn as stocks dipped in response.

Regardless, this sentiment that gaming addiction is harming Chinese youth plagued Q1 of 2024, casting a foreboding shadow over Chinese game development. Given the uncertainty within their industry, it’s worth looking at which Chinese publishers are performing best this year by examining the performance of their games on live-streaming platforms.

MOBAs and Mobile Games Mark Success for Chinese Publishers

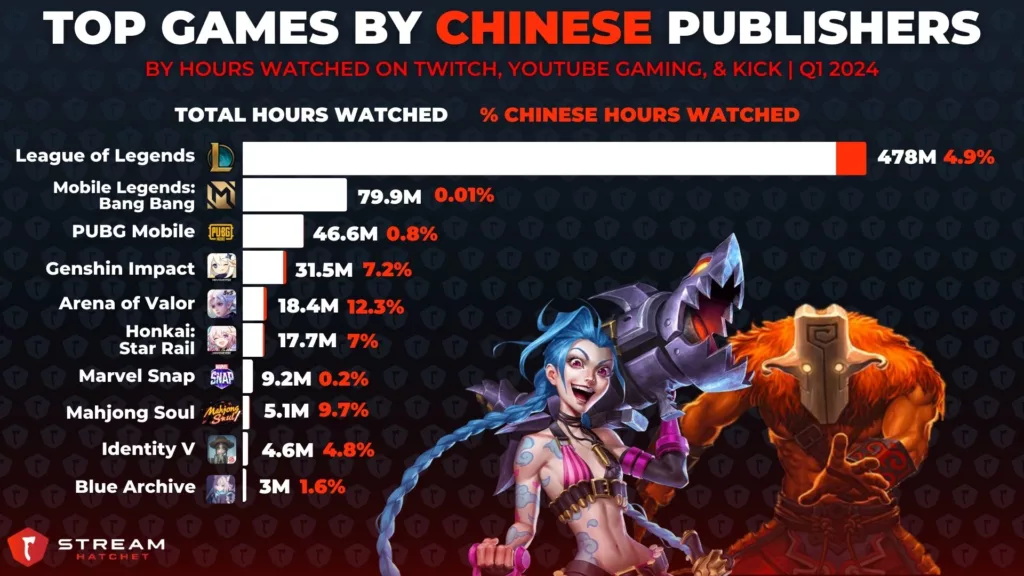

The top games by Chinese publishers are mainstays of the online space. Three of the top five titles are MOBAs, with League of Legends leading the way with 478M hours watched during Q1 2024. Notably, however, only 4.9% of this viewership came from Chinese audiences. League of Legends viewership was boosted by the spring season of the League of Legends Pro League 2024, China’s national competition for the game.

Aside from MOBAs, mobile games are also performing strongly. This includes mobile MOBAs of course, like Mobile Legends: Bang Bang and Arena of Valor with 79.9M and 18.4M hours watched respectively. Keep in mind that Mobile Legends: Bang Bang gets virtually none of its viewership from China itself (just 0.01%). PUBG Mobile is the only shooter cracking the top 10 at 46.6M hours watched.

Lastly, Gacha games also take pride of place among the top games by Chinese publishers in live streaming. Genshin Impact and Honkai: Star Rail continue to pull in viewership, despite their existence coming under threat from the aforementioned anti-addiction regulations.

Tencent’s Sprawling Reach Dominates Over Other Publishers

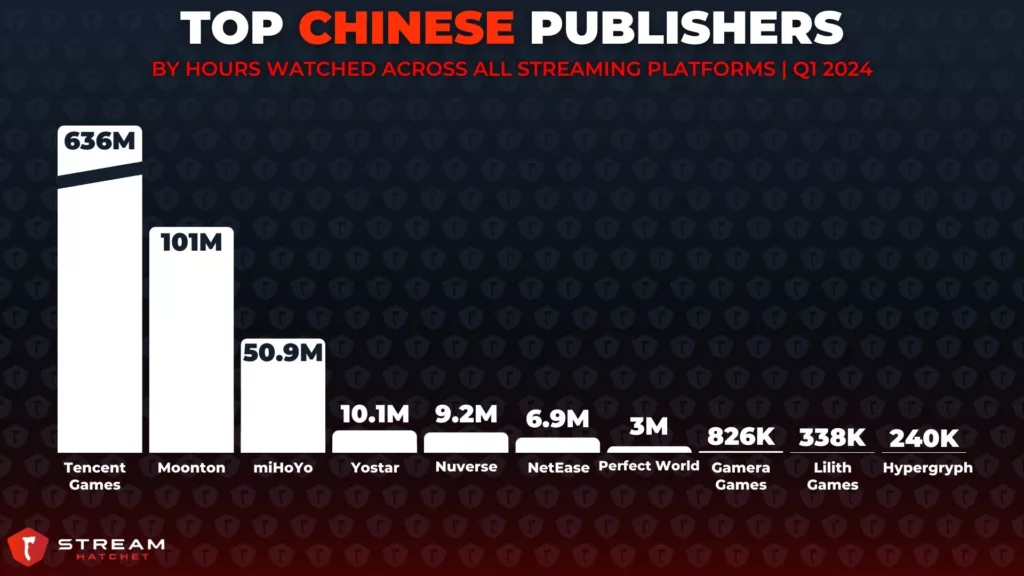

Given the previous data, it’s no surprise that the two biggest Chinese publishers are behind the biggest MOBAs. Tencent, owner of Riot Games since 2011, brought in a massive 636M hours watched across Q1 2024, far outperforming even the second most popular Chinese publisher, Moonton, at 101M hours watched. Regardless, Moonton’s success with Mobile Legends: Bang Bang does show a gradual shift towards mobile gaming. miHoYo then comes in third place with 50.9M hours watched, representing the enduring popularity of Gacha games.

Tencent Attempts to Reignite its Creative Spark with AI

Given how dominant Tencent currently is, it’s worth looking at their performance in Q1 2024 and how the conglomerate views the current gaming landscape. Reflecting on Tencent’s output in 2023, co-founder and CEO Pony Ma remarked that the company was at a loss as “competitors continue to produce new products” while Tencent felt they had “achieved nothing”. Despite backing some of the biggest games in the industry, Tencent feels they have creatively stagnated.

To combat this, Tencent has undertaken a number of initiatives to diversify its portfolio and invest in new technologies. As mentioned, mobile games continue to rise in popularity. Via its international arm Level Infinite, Carson Taylor, Product Strategist at Samsung Electronics America, recently wrote a fantastic piece looking at the competition between Tencent’s NBA Infinite and NetEase’s Dunk City Dynasty for Naavik’s newsletter, showing Chinese publisher interest in the sports game genre.

Tencent has also been investing in AI, unveiling its new Hunyuan large foundation model in September of last year – a form of generative AI. This push towards AI is already impacting Tencent’s game development, with a couple of key examples being presented at GDC 2024 in April. Naruto Mobile, for example, was the first game to use a reinforcement learning approach to train the game’s CPU combatants – a task that would have taken a human trainer ten times as long. Tencent’s GiiNEX Game AI Engine is even more robust, helping developers to create 3D city scenes, animations, and procedurally generated dialogue.

Chinese publishers continue to struggle to find innovation, looking to foreign markets and indie breakout hits such as Palworld for inspiration to escape local strictures. Stream Hatchet will be watching as Chinese publishers navigate these turbulent changes in viewership demand, combined with the increasing pressure of gaming regulators.

To be notified when Stream Hatchet releases full regional live-streaming reports including top streamers and esports performance, follow the Stream Hatchet newsletter: