For new entrants to the live-streaming arena, the sheer mass of information can be overwhelming. Platforms, streamers, gaming titles, variety content: With so many interesting trends emerging, evolving, and fading at the lightspeed rate of online discourse, it can be hard to separate out what’s important. To help you demystify this industry, we’re covering the basics of the Korean streaming platform that succeeded Twitch: Chzzk.

What is Chzzk exactly? Launched by Naver in December 2023, Chzzk was built specifically to fill the void left when Twitch shut down operations in South Korea. Backed by Korea’s dominant search engine and tech conglomerate, the platform deliberately mirrors Twitch’s UI while integrating deeply with Naver’s ecosystem of services. In just over two years, Chzzk has captured 39% of the Korean live-streaming market and now rivals SOOP Korea as the country’s top platform.

Five Crucial Points to Understand About Chzzk:

- Chzzk’s Founding and Evolution

- Chzzk’s Business Model

- Chzzk’s Relationship with Streamers

- Chzzk-specific Features

- The Current State of Chzzk

_

One of the most powerful tools at your disposal is information: Access Stream Hatchet’s latest yearly report to learn about the trends shaping live streaming.

TL;DR Takeaways by Stream Hatchet:

- Chzzk accounts for 39% of all Korean viewership as of Q4 2025

- Although SOOP Korea still has slightly higher viewership per month, Chzzk was able to temporarily overtake it in Dec 2024

- The two best performing types of content by far are Talk (Just Chatting) and League of Legends streams, with over 140M hours watched each in 2025

Chzzk’s Founding and Evolution

When Twitch announced in early December 2023 that it would shut down operations in South Korea due to “prohibitively expensive” network costs, the Korean streaming community faced an existential crisis. In stepped Naver, Korea’s dominant search engine and tech conglomerate, which responded by launching Chzzk: A new streaming platform built specifically to replace Twitch in the Korean market. The timeline was lightning-fast:

- Internal testing with League of Legends tournaments started on December 5th 2023…

- Followed by an official beta test announcement on December 6th…

- Then Twitch held a business meeting with Naver to discuss transferring streamers on December 7th…

- And by December 19th, Chzzk’s open beta had launched.

- So when Twitch officially shut down on February 27th 2024, Chzzk had already positioned itself as the platform’s spiritual successor.

_

Naver brought serious firepower to the fight as a sprawling tech conglomerate operating e-commerce, the LINE messaging app, Webtoon, and Naver Pay. The strategy was simple: Make the transition from Twitch as painless as possible. Chzzk’s UI was deliberately designed to mirror Twitch’s layout, and the platform launched a Twitch Subscription Import Campaign that let users transfer their subscriptions and follower lists directly.

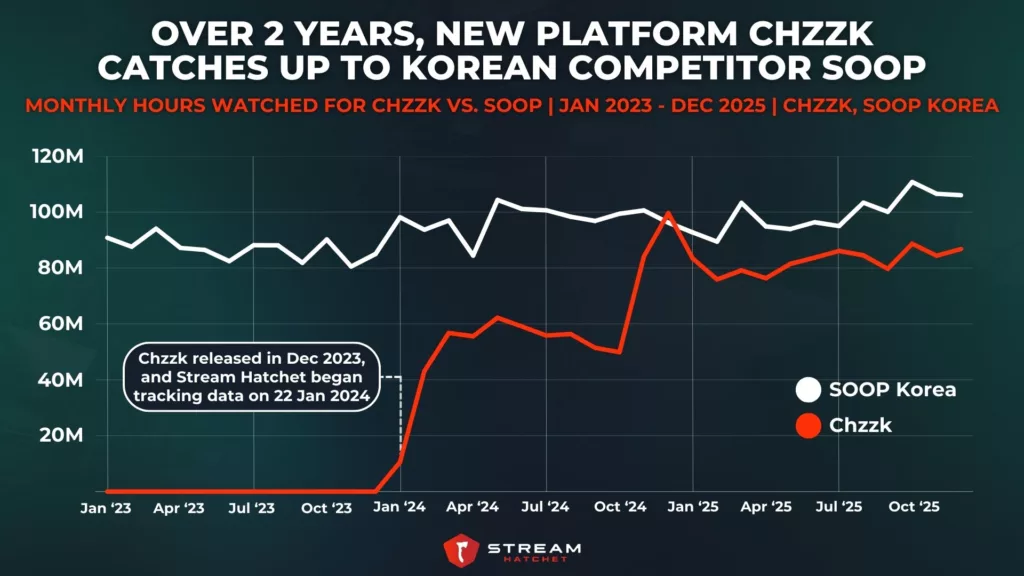

But Chzzk still needed to find its footing in a crowded market. Although the platform launched its open beta in December 2023, we began tracking it on January 22nd 2024. Chzzk climbed rapidly through the first half of 2024, hitting around 60M hours watched by March 2024. The upward momentum continued into late 2024, with a notable spike in November and December of 2024 that momentarily pushed Chzzk ahead of its direct competitor SOOP Korea. Since then, Chzzk has settled into a consistent range between 80M-90M hours watched per month through the end of 2025.

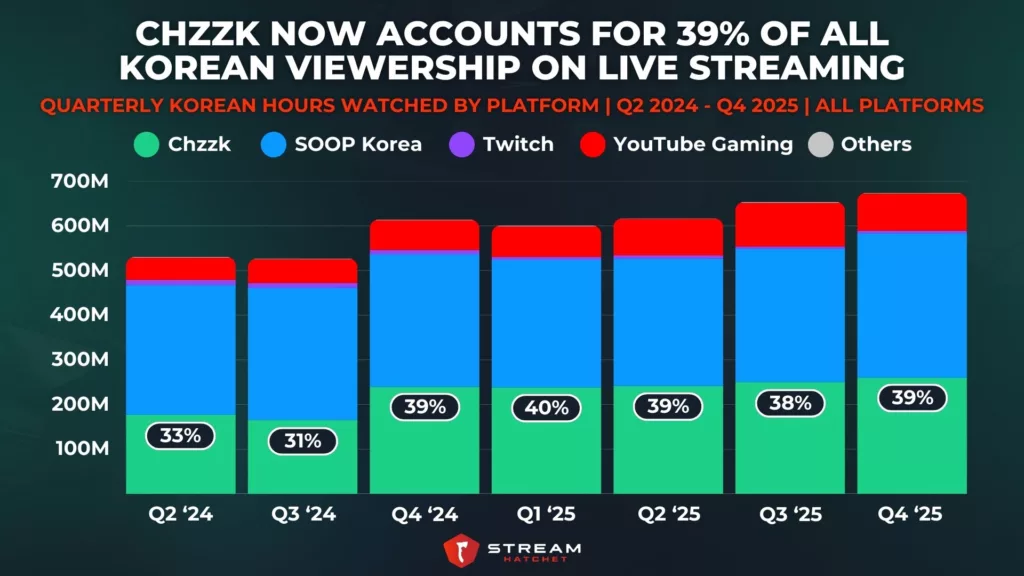

When you zoom out to look at the entire Korean live-streaming landscape, Chzzk’s rise becomes even more impressive. The platform now accounts for 39% of all Korean hours watched across live-streaming platforms as of Q4 2025, up from just 33% in Q2 2024. That growth happened while the overall Korean streaming market expanded significantly, with total quarterly hours watched jumping from around 530M in Q2 2024 to roughly 680M by Q4 2025. SOOP Korea remains the leader in terms of raw viewership, but its share has actually contracted slightly over this period. YouTube Gaming holds steady at around 10-15% of the market, while Twitch’s presence has understandably diminished to nearly nothing following its exit from the region.

Chzzk’s Business Model

Unlike most streaming platforms scrambling for profitability, Chzzk has the luxury of being backed by Naver, Korea’s search giant. Internally, Chzzk is positioned as a “standalone revenue engine,” not just a promotional side project. The platform’s monetization follows the standard playbook: Taking a cut of subscriptions and sponsorships, plus ad revenue. But this monetization is powered up by Chzzk’s integration with Naver’s ecosystem: Chzzk plugs directly into Naver Pay for payments, Naver Shopping for commerce, and the company’s cloud infrastructure.

Where Chzzk really threw its weight around was esports. In December 2025, Naver secured a 5-year exclusive deal with Riot Games for domestic Korean-language broadcasts of the LCK from 2026 to 2030. The deal, described as one of the largest in esports history, also includes international tournaments like Worlds and MSI, plus naming rights to the LCK’s home venue, now rebranded as “CHZZK LoL Park.” Add in 3-year exclusive Korean broadcast rights for the Esports World Cup (2025-2027), and the strategy is clear: Use Naver’s cash reserves to dominate Korean streaming while betting that deep ecosystem integration will eventually turn Chzzk into a revenue driver rather than just a cost center.

Chzzk’s Relationship with Streamers

Chzzk operates with three streamer tiers: Rookie, Professional, and Partner. Every streamer starts as a Rookie with no requirements, giving them immediate access to the platform. To reach Professional status, streamers need 150 followers, 500 total viewers, and 20 hours of broadcast time over the past year. They can then apply through the Studio dashboard for Professional status themselves… but Partner status works differently. There’s no application process for Partners: Chzzk reaches out directly to headhunt streamers and sees if they want to sign.

The tier system directly impacts how much money streamers keep. For “Cheese” donations (Chzzk’s equivalent to Twitch Bits), Rookie streamers get a 60/40 split in their favor. Professional streamers see 70/30, and Partners get the best deal at 80/20. Subscriptions are simpler: Everyone gets a 70/30 split regardless of tier. Advertising revenue is where the hierarchy becomes most apparent. Rookies don’t earn any ad revenue at all, Professionals get 35% while Chzzk takes 65%, and Partners receive 55%. Just like on other live-streaming platforms, more viewership means a higher status and more revenue to keep you on the platform.

BUT! Moving up the ladder comes with restrictions. Rookies can multistream to other platforms and use third-party donation services like TooneyShown or Twip, giving them maximum flexibility to build audiences wherever they can. But Professionals and Partners are restricted: No multistreaming, and no third-party donations.

Regardless, streamers who made the jump from Twitch to Chzzk early reaped the rewards. 한동숙 (Han Dong-sook) saw his average viewership explode by 324% after moving from Twitch, becoming Chzzk’s top channel in Q1 2024 with over 14K average viewers. This pattern held across the board: Wolf, Pungwolryang, and Tahyoni all became major success stories as early adopters. Chzzk made the transition easier with its Twitch Subscription Import Campaign, allowing streamers to bring their subscriber bases and carry over subscription tenure. The platform even integrated Twitch follower lists, minimizing the friction of starting fresh on a new platform.

Chzzk-specific Features

We’ve already touched on Chzzk’s biggest unique advantage: Total integration with Korea’s largest internet company. The platform connects directly to Naver Pay, letting users buy “Cheese” donations with accumulated points from shopping and other Naver services. Smart Store connectivity lets Partners link their merchandise shops to their channels. And Naver Cafe connectivity means fan communities built over years on the platform can link seamlessly to Chzzk channels, preserving existing relationships. From a business POV, this integration is also very sticky: It’s a Naver ecosystem lock-in. Once creators connect their Smart Store, build their Naver Cafe community, and accumulate Tongnamoo Power engagement, switching platforms means abandoning infrastructure that took months to build.

Oh yeah, we haven’t explained Tongnamoo Power yet! Chzzk borrowed Twitch’s channel points concept but gave it a Korean twist with “Tongnamoo Power.” Viewers earn points by watching streams, which they can then wager on “Seungbu Yecheuk” (prediction battles) where streamers set up outcome-based betting on anything from game results to challenge completions. Winners get their points multiplied based on the odds, while losers walk away empty-handed. It’s Twitch channel points with actual stakes, and the feature saw immediate adoption when it launched.

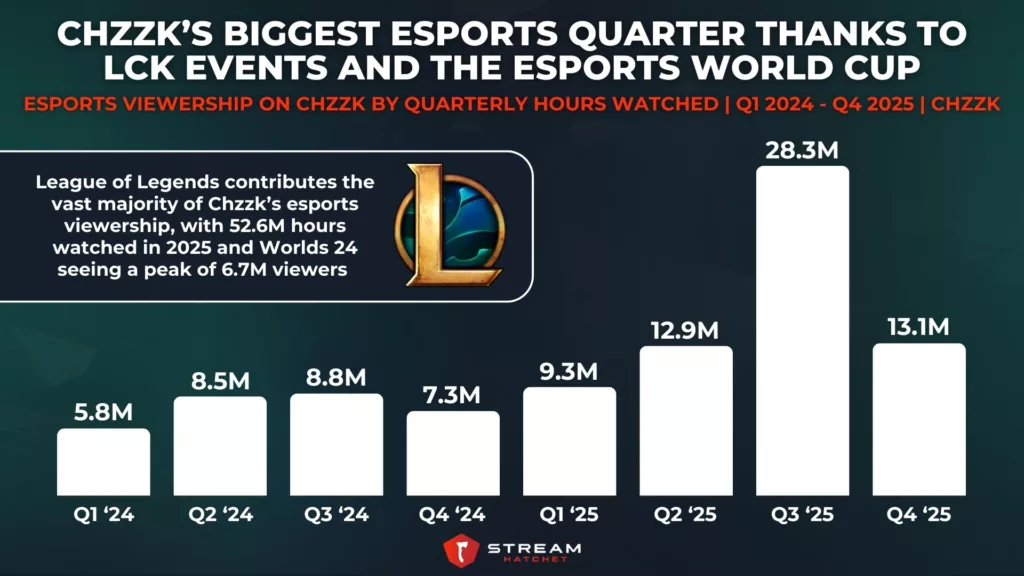

As mentioned before, Chzzk has also carved out a niche in certain esports fields. The platform hit 28.3M esports hours watched in Q3 2025, its biggest quarter ever, driven largely by broadcasting rights for major tournaments like the Esports World Cup and the League of Legends Champions Korea (LCK). That’s nearly a 5X jump from the 5.8M hours watched back in Q1 2024. League of Legends dominates Chzzk’s esports viewership, contributing 52.6M hours watched across all of 2025, with Worlds 24 hitting a peak of 6.7M concurrent viewers on the platform. This aggressive pursuit of exclusive esports rights sets Chzzk apart from SOOP Korea, which has traditionally relied more on community casting and individual streamers rather than official tournament broadcasts.

The Current State of Chzzk

Now that you’ve got a handle on what exactly Chzzk is, it’s time to dive into the top streamers and games shaping the platform on a day-to-day basis.

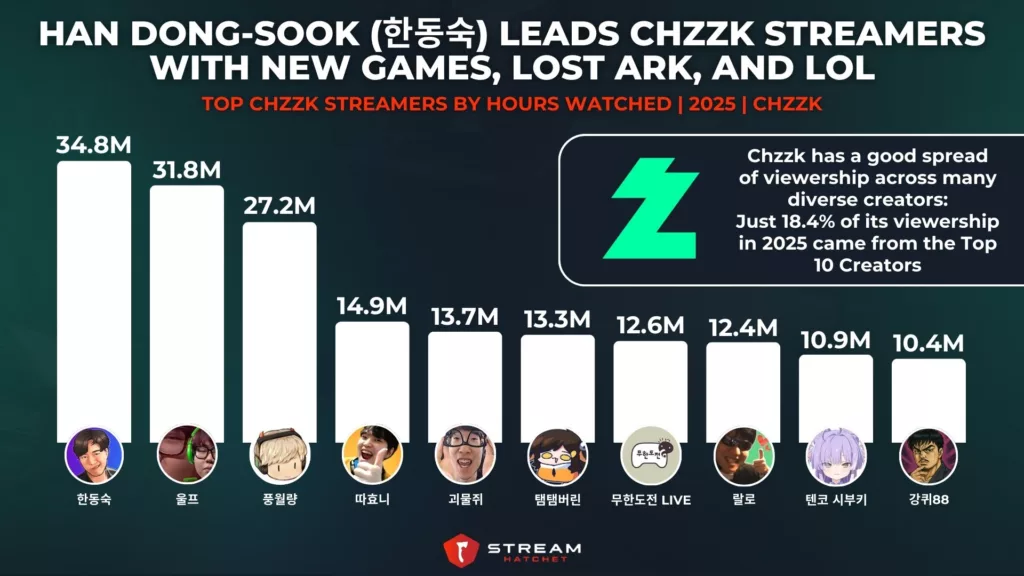

Han Dong-sook (한동숙) dominated Chzzk in 2025 with 34.8M hours watched, cementing his position as the platform’s biggest draw. The League of Legends and variety game streamer successfully made the jump from Twitch after the platform’s Korean exit, bringing his fanbase along for the ride. Close behind him is Wolf (Lee Jae-wan, 울프) with 31.8M hours watched, known for his ties to T1 esports and LoL. Third place goes to (another) LoL streamer Poong Wol-ryang (풍월량) at 27.2M hours watched, while DDaHyoNi (Baek Sang-hyeon, 따효니) rounds out the top four with 14.9M hours watched with his pro Hearthstone deck-building skills and variety content.

What’s notable here is how evenly distributed viewership is across Chzzk’s creator base. The platform’s top 10 streamers only accounted for 18.4% of total viewership in 2025, suggesting Chzzk has built a healthy, more diverse creator ecosystem rather than becoming overly dependent on a handful of personalities. That’s a stark contrast to smaller platforms where a few mega-streamers can dominate 30-40% of total hours watched. The mix of content types in the top 10 also tells a story: League of Legends remains king, but you’ve got MMO streamers, variety gamers, professional Hearthstone players, and VTubers all finding success, which speaks to Chzzk’s ability to support multiple streaming niches rather than just one dominant category.

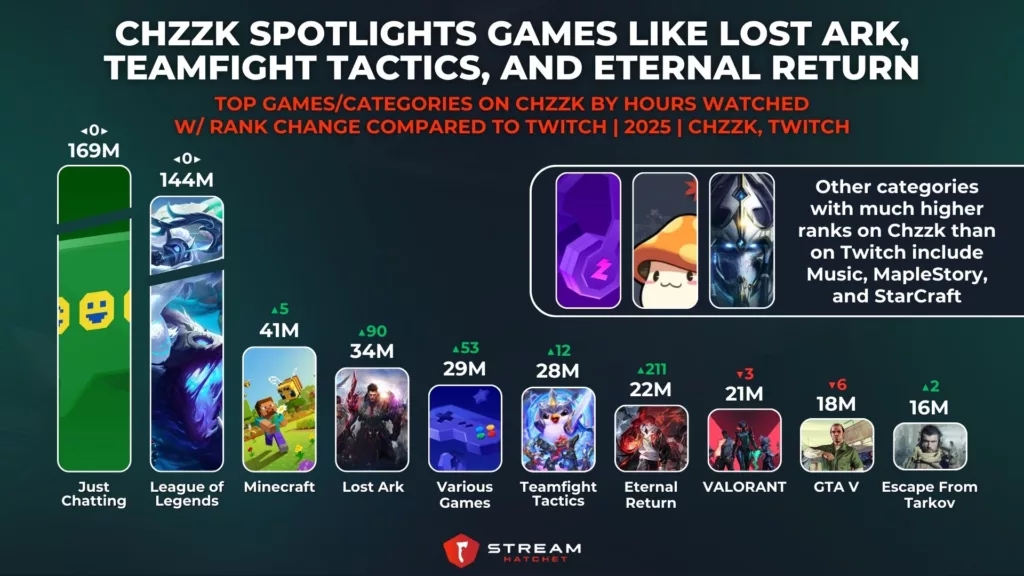

Just Chatting content (called “Talk” on Chzzk) rules Chzzk with 169M hours watched in 2025, matching the trend of growing non-gaming popularity seen on other live-streaming platforms. No shock that League of Legends comes in second at 144M hours watched showing the MOBA’s ironclad grip on Korean streaming. But the real story is how Chzzk elevates locally-developed Korean games with far less visibility on Western platforms. Lost Ark sits 90 ranks higher on Chzzk vs. Twitch with 34M hours watched, while Teamfight Tactics is 12 spots higher at 28M hours watched. These rank improvements suggest Chzzk’s audience gravitates toward games that have strong Korean development roots and deep strategic gameplay that resonates with local tastes.

More differences compared to Twitch that publishers and brands should be aware of? Music content, MapleStory, and StarCraft all rank significantly higher on Chzzk, speaking to uniquely Korean streaming preferences. Eternal Return is a massive 211 ranks higher than on Twitch, reaching 22M hours watched: The Korean-developed battle royale has found a dedicated home on Chzzk despite minimal traction on Western platforms. Meanwhile, VALORANT sits three spots lower at 21M hours watched and GTA V is six ranks lower with 18M hours watched, suggesting that while these Western mega-hits still perform well, they’re not dominating Chzzk the way they do on Twitch.

_

Chzzk’s first two years have proven that regional streaming platforms can thrive when backed by the right infrastructure and strategic investments. The platform’s aggressive pursuit of esports broadcasting rights, combined with deep integration into Naver’s ecosystem, has created a sticky product that Korean creators and viewers have rallied behind.

The question now is whether Chzzk can maintain momentum. SOOP Korea remains a formidable competitor with decades of brand loyalty, and YouTube Gaming continues to pull strong viewership for major esports events. But Naver’s deep pockets and Chzzk’s laser focus on Korean preferences have allowed the platform to define the post-Twitch Korean streaming landscape. For brands and publishers looking to reach Korean gaming audiences, understanding Chzzk’s ecosystem is essential.

To keep up to date with the latest insights into the live-streaming industry, follow Stream Hatchet and receive exclusive newsletter-only content: