As the Switch nears the end of its lifecycle, gamers are nervously anticipating the announcement of the so-called “Switch 2”. Fans are holding back on big purchases, seeing Nintendo’s revenue sink 17% YoY down to ¥276.7B for fiscal Q2 2024. Nintendo has been tiding fans over with transmedia strategies and legacy building such as the super successful Super Mario Bros. Movie, the opening of the Nintendo Museum, and expansions to Super Nintendo World.

But people still want to see Nintendo doing what they do best: Making revolutionary game consoles and innovating within their much-loved IPs. The second half of 2024 has seen three smaller titles launching with The Legend of Zelda: Echoes of Wisdom, Super Mario Party Jamboree, and now the latest title Mario & Luigi: Brothership. But with so much hype for Nintendo’s next console generation, these titles might be overlooked by impatient streamers.

In this article, we’re looking at how Mario & Luigi: Brothership performed on live-streaming platforms, including a look back at Nintendo’s best performing titles and a glimpse into the online chatter around the upcoming Switch 2.

Mario & Luigi: Brothership Reawakens the Dormant Mario RPG Series

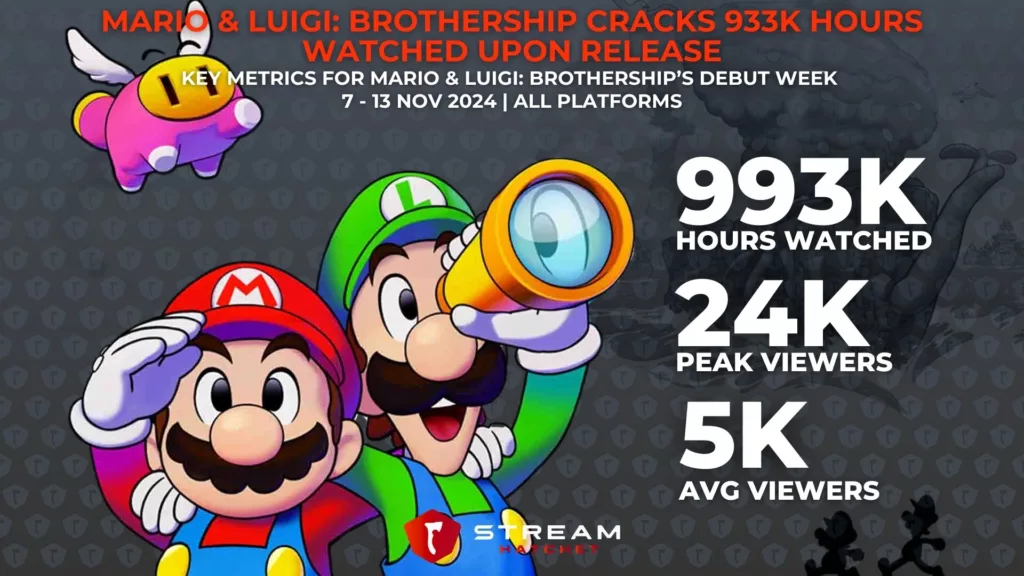

Mario & Luigi: Brothership had a warm reception on live-streaming platforms, generating 933K hours watched in its debut week despite the lack of fanfare around its release. For comparison to a similar title in both gameplay scope and IP recognition, Sonic X Shadow Generations brought in slightly lower viewership at 831K hours watched. While this indicates a decent performance for the game, it pales in comparison to the other recently released Nintendo RPG remakes like Super Mario RPG and Paper Mario: The Thousand-Year Door which generated 3.9M and 2.6M hours watched in their respective debut weeks (no doubt boosted by nostalgia).

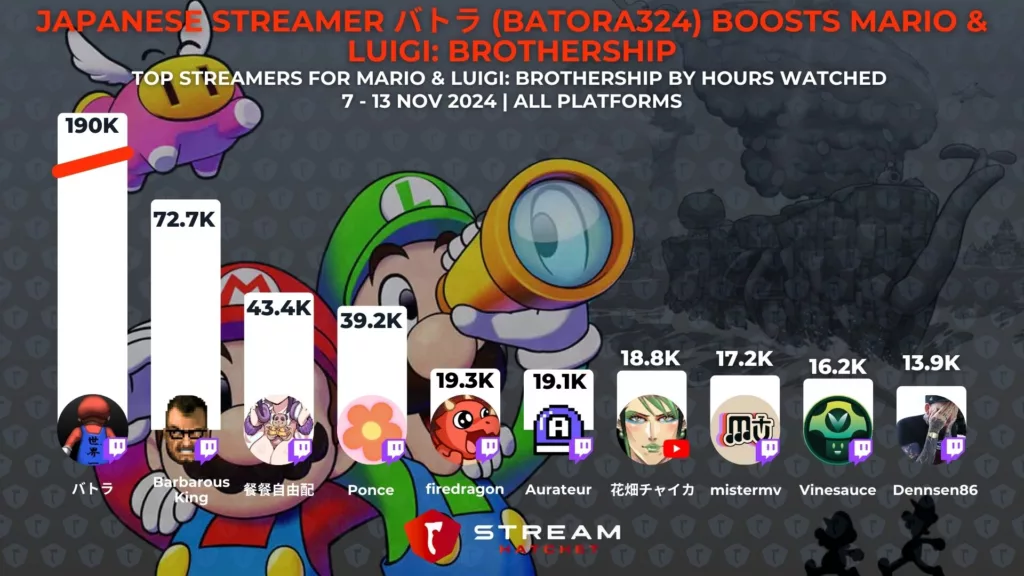

Additionally, Mario & Luigi: Brothership owes much of its success to top streamer バトラ (Batora324) who pulled in 190K hours watched – a full 20.4% of the game’s total viewership. This focused dependence on certain creators for exposure suggests a lack of influencer marketing collaboration for promoting Nintendo’s games. In saying that, Nintendo does have known influencer partnerships with select content creators like Wood, SMG4, and Nintendo Unity. English-speaking streamer BarbarousKing is an example of a loyal Nintendo fan who consistently covers Nintendo’s first-party releases, this time bringing in 73K hours watched for Mario & Luigi: Brothership.

Nintendo’s Peak Presence on Live Streaming Rests on Pokémon and Cozy Games

Nintendo has a number of game franchises that have live-streaming compatibility, bringing their classic IP to a modern audience. Among the top games by peak weekly viewership, Pokémon games occupy 4 of the top 10 spots (led by Pokémon Scarlet & Violet with 26M hours watched in its release week). Note that this list only includes first-party Nintendo titles released during or after January 2020 (primarily sourced here), so there are some notable exceptions like Mario Kart and Super Smash Bros. Ultimate.

The games that break from this Pokémon trend reveal unique interactivity between live streaming and Nintendo games. Animal Crossing: New Horizons is a particularly interesting example, thriving off of the pandemic-era boost in live-streaming viewership to reach 18.7M hours watched as viewers sought a cozy escape from reality. The immense hype for The Legend of Zelda: Tears of the Kingdom explains its monumental viewership (18M), while Splatoon 3’s competitive gameplay pulled more hardcore viewers onto live-streaming platforms (10M). Although Nintendo is typically associated with casual gamers, this range of avenues onto live streaming proves that even dedicated gamers are finding ways to pursue their content through an online community.

Hype for Switch 2 is Building on Live Streaming, Even Beyond Nintendo Game Streams

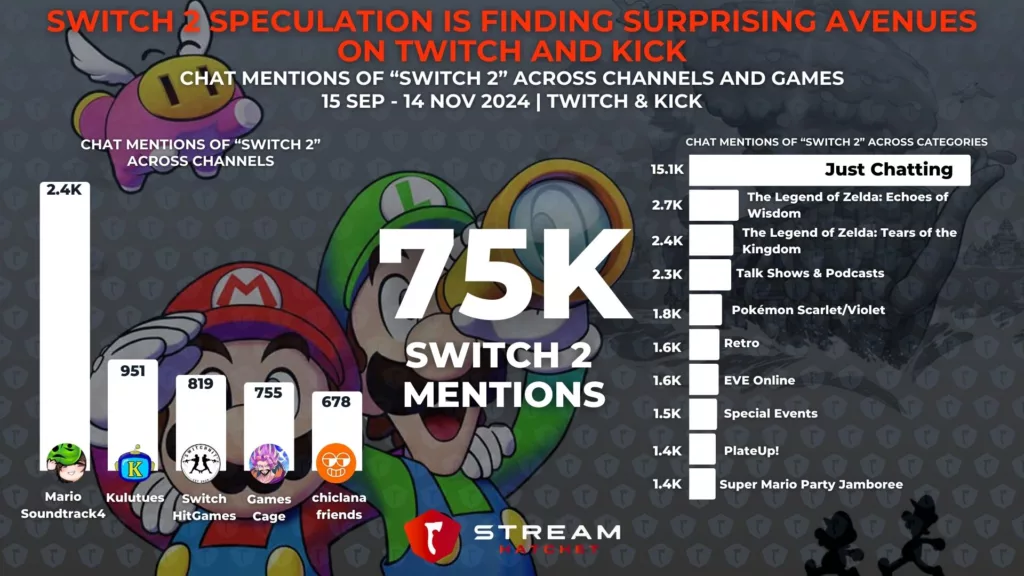

It’s no secret that Nintendo fans are desperate for Switch 2 news – not just for the new console and performance upgrades, but for first-party launch titles from beloved series like a new 3D platformer Mario and, potentially, the new Metroid Prime. In the past couple of months alone, “Switch 2” has been mentioned 75K times across Twitch and Kick. Twitch streamer MarioSoundtrack4 had the most mentions (2.4K), but this discussion is spread across a great many channels. Looking at chat mentions by Twitch categories, a couple of unexpected games pop up for Switch 2 discussion including EVE Online (1.6K mentions) and Plate Up! (1.4K mentions). Of course, the bulk of speculation occurs on stream categories dedicated to pure discussion like Just Chatting (15.1K mentions) and Talk Shows & Podcasts (2.3K mentions).

While this excitement for the Switch 2 suggests a large pool of potential buyers, a new console is always a double-edged sword. Part of why the Switch has endured so long is the gradual accumulation of momentum from consistent new console sales, building that fanbase. The leap to Switch 2 risks leaving behind a lot of casual gamers who don’t regularly buy consoles – the exact segment of the market that Nintendo caters to. Nintendo is aware of how crucial it is to capitalize on pre-existing buyers, moving to an “Unfold” revenue system for some of its bigger titles like Super Smash Bros. Ultimate and Pokémon.

A culture of “overhype” has developed around Nintendo Directs, leading to such emotional responses from fans that Nintendo warns users when much-anticipated news won’t be announced to avoid disappointment and subsequent flaming online. While the roadmap of these last three first-party titles has stemmed the tide of dissatisfaction temporarily, Nintendo will be looking to announce the Switch’s successor soon and give fans something concrete to be excited about in 2025.

To keep up to date with the latest big game launches on live streaming, follow Stream Hatchet: