When Sonic Racing: CrossWorlds launched this year, Sega positioned it directly against Mario Kart World by promising faster tracks, bolder physics, and running comparison ads that claimed to “out-race” Nintendo’s icon. The campaign generated curiosity online, reigniting the old Nintendo Vs. Sega feud to drive interest. It was a thoroughly modern interpretation of a time-tested marketing strategy which partly made use of streaming to get the word out.

Compare that to Nintendo: A company that, though innovative, has been careful about adopting modern gaming marketing strategies. Nintendo maintains strict control over how its games are shown and shared, so it’s surprising that Nintendo games still garner so much organic interest (such as the overwhelming coverage for the Switch 2’s launch). In this article, we’re going to compare how Nintendo games perform against competitors with similar gameplay from other publishers to gauge who comes out in front on live-streaming.

TL;DR Takeaways by Stream Hatchet:

- Comparing their best months, Nintendo games bring in 10X the viewership of their competitors

- More than 20% of Nintendo game audiences consistently check out similar competitor games on streaming upon release

- Nintendo’s back catalog of retro titles shores up viewership, accounting for over 30% of the publisher’s viewership over the past 5 years

Nintendo Games Far Outperform Their Competitors on Streaming

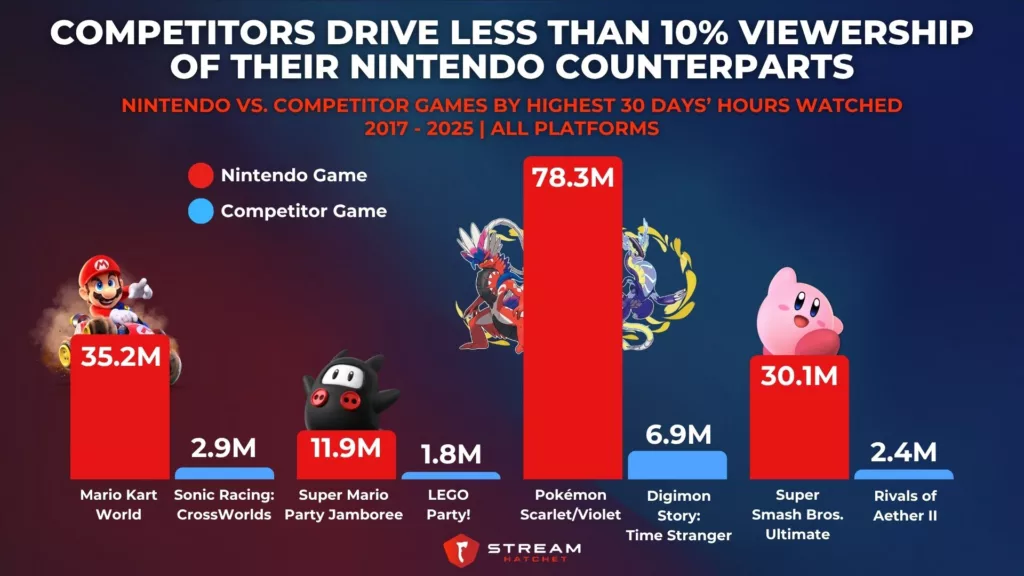

To try and get a fair comparison of Nintendo games and their competitors, we picked out four pairs of games with very similar gameplay/creative origins and compared a range of metrics between the two games:

- Kart Racers: Mario Kart World vs. Sonic Racing: CrossWorlds

- Party Games: Super Mario Party Jamboree vs. LEGO Party!

- Monster Capture Games: Pokémon Scarlet/Violet vs. Digimon Story: Time Stranger

- Platform Fighters: Super Smash Bros. Ultimate vs. Rivals of Aether II

The upshot? Nintendo games trounce their competitors when it comes to pure viewership. Across all live-streaming platforms, the sample Nintendo titles saw more than 10x the viewership of their competitor games during their respective peak 30-day periods. Mario Kart World reached 35.2M hours watched during its peak 30-day window, compared to just 2.9M for Sonic Racing: CrossWorlds. Super Mario Party Jamboree outpaced LEGO Party! by a similar ratio though with far lower viewership, and ditto for Super Smash Bros. Ultimate compared to Rivals of Aether II. Pokémon Scarlet/Violet had the highest hours watched (no surprise) with 78.3M hours watched, but the well-reviewed Digimon Story: Time Stranger’s 6.9M hours watched is very respectable.

So, Nintendo games are still the definitive versions of these formats for most live-streaming viewers… but is the tide shifting?

How Audiences Shift Between Nintendo Games and Their Competitors

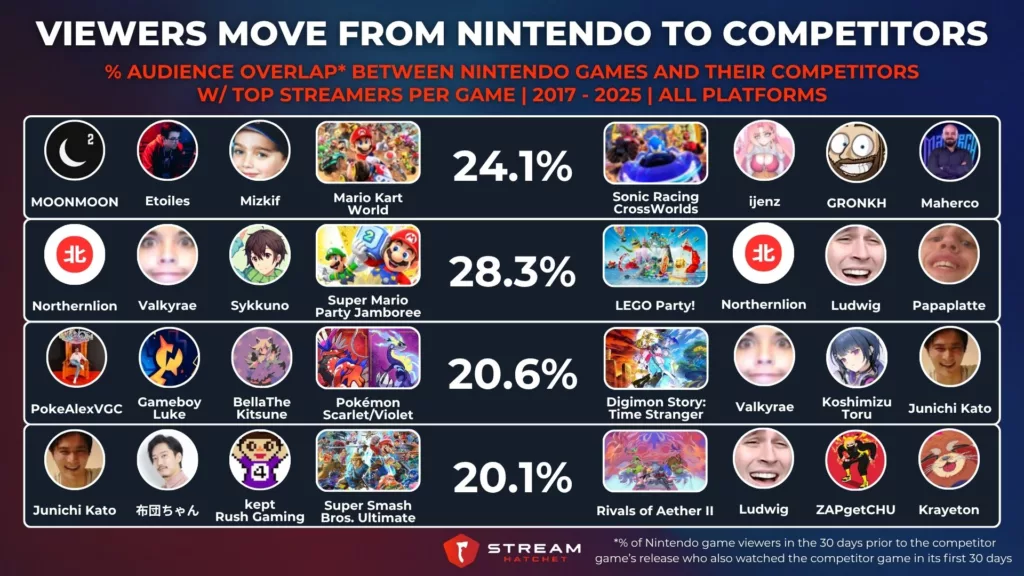

Even with this seeming stranglehold on certain gameplay styles, Nintendo’s audience is still open to exploring similar titles. In every example we looked at here, over 20% of viewers who watched the Nintendo games just before the competitor game’s release also tuned into competitor games within their first month. For example, 24.1% of Mario Kart World’s audience watched Sonic Racing: CrossWorlds in its first month, while Super Mario Party Jamboree had the highest overlap among the sampled games at closer to 30%. This curiosity is an opportunity for competitors to seize upon when releasing their similar titles.

However, part of this overlap is owed not to the games, but to the streamers covering said games. Take Northernlion, for example, who was the top streamer for both Super Mario Party Jamboree and LEGO Party! in the periods examined: His audience followed him from one game to the next. You can see a similar publisher-agnostic attitude from streamers like Valkyrae and Junichi Kato. Publishers should turn to well-known streamers in these formats to access new audiences with a proven interest in their gameplay style.

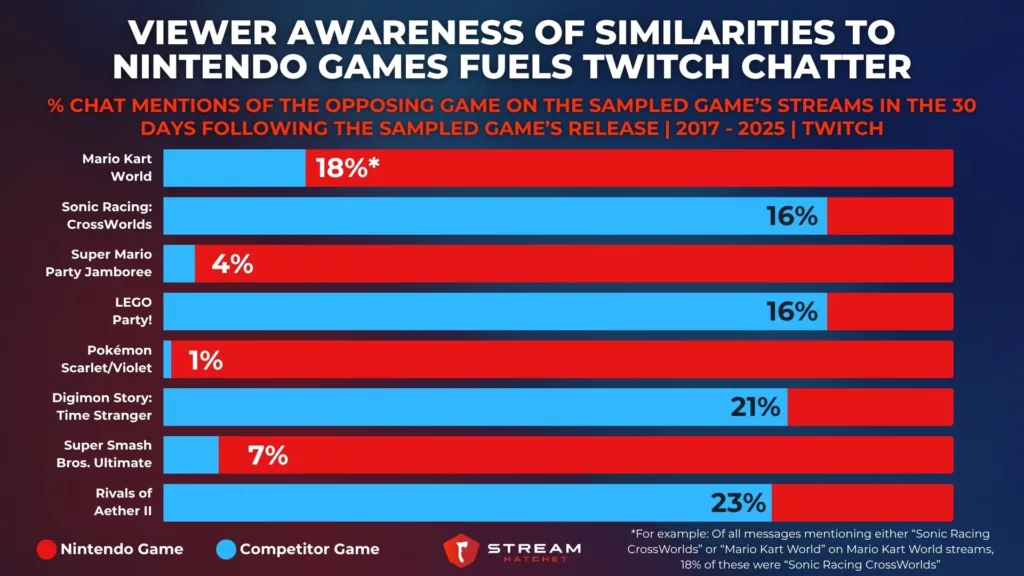

Twitch viewers are well aware of the similarities between these titles, with discussions on competitor streams often including direct references to Nintendo titles. Across all the sample games, 16-23% of chat mentions that included at least one of the game’s titles were referencing the Nintendo game on the competitor game’s stream. In other words, the Nintendo game mentions accounted for roughly one-fifth of game mentions even on the competitor’s stream. But when you look at streams of the Nintendo game, competitor mentions accounted for just 1-7%.

One interesting exception appears with Sonic Racing: CrossWorlds, however. On Mario Kart World streams, 18% of all chat mentions about either game referenced Sonic Racing: CrossWorlds, which is actually a higher share than the reverse. For once, a competitor managed to get people talking about it within the Nintendo ecosystem, a testament to Sega’s clever marketing strategy. Of course that still means the conversation was framed around comparison, but leaning into this instead of shying away at least evened the playing field and put Nintendo’s kart racer under the microscope as well.

Nintendo’s OG Status Propped Up By Love For Retro Games

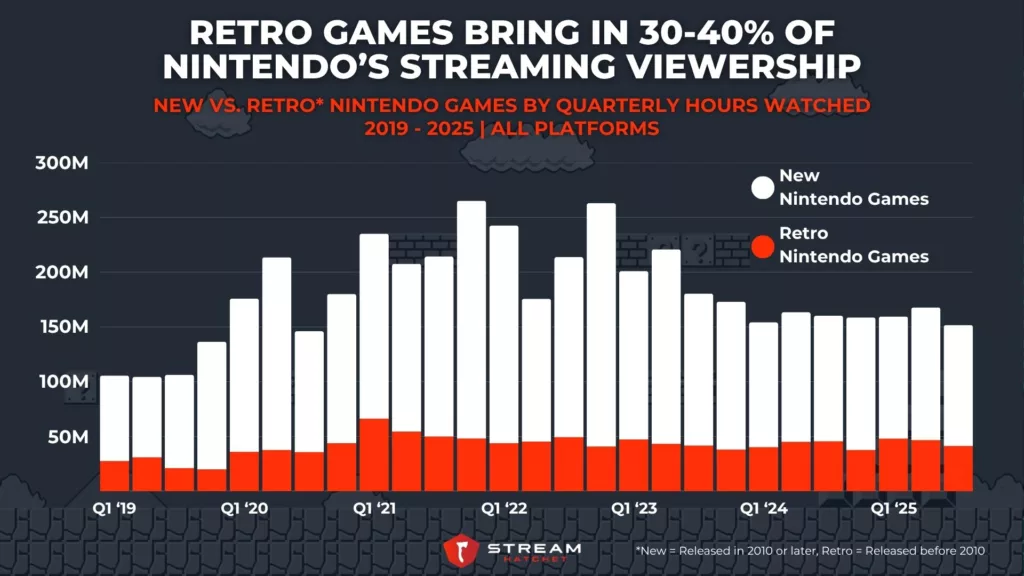

The strength of Nintendo’s IP makes it hard to shake as the benchmark for certain genres and gameplay styles. While competitors focus on the next big release, Nintendo’s greatest strength lies in its back catalog. Over the past six years, retro Nintendo games (defined here as having been released before 2010) have accounted for 30–40% of the publisher’s total live-streaming viewership.

This long-term base of retro viewership reflects more than nostalgia: It demonstrates the brand loyalty Nintendo has built over generations. While new titles create temporary spikes in attention, older Nintendo games provide a steady foundation that keeps the live-streaming community engaged. This reputation helps the company weather the storm when one of their newer titles receives negative feedback.

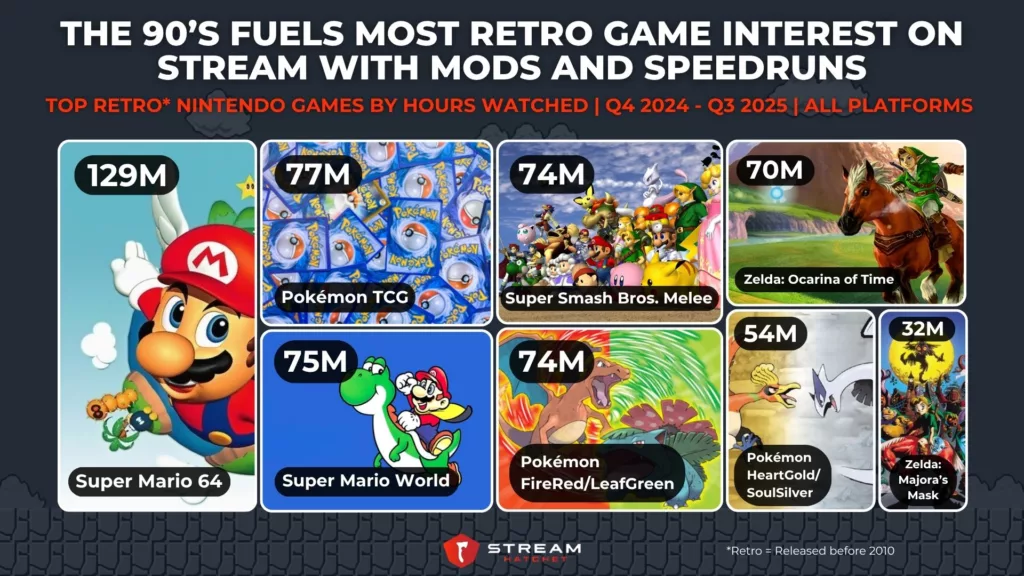

The bedrock of live-streaming support for Nintendo’s retro titles is set in one particular decade: The 90s. Looking at retro games by hours watched over the past year, Super Mario 64 leads with 129M hours watched, followed by other 90s classics like Super Mario World (75M), Pokémon FireRed/LeafGreen (74M, remakes), Super Smash Bros. Melee (74M), and Zelda: Ocarina of Time (70M). Together, these classics shaped the genres that still dominate today, even rivalling the yearly viewerships of some newer releases.

Each of these games has also developed its own subculture on live-streaming platforms that keeps content fresh. Super Mario 64 drives a passionate speedrunning and modding scene, while Super Smash Bros. Melee sustains one of gaming’s most enduring competitive communities. Pokémon FireRed/LeafGreen and HeartGold/SoulSilver thrive through nuzlocke challenges and randomizer runs, while Ocarina of Time and Majora’s Mask inspire glitch showcases and story-based replays. These creative reinventions are evolving experiences that continue to attract new audiences and pull older fans back in.

Nintendo and Sega’s Differing Attitudes Towards Modern Gaming

As the top dog here, Nintendo can lean on its legacy for support and spark nostalgia to draw in players. However, this has also made Nintendo fiercely protective of its IP in general, particularly when it comes to newer games and online coverage of those games. Compared to other Japanese publishers, Nintendo has been reluctant to embrace modern forms of game marketing or dilution of its IP through collaboration with other franchises (with notable exceptions like Super Smash Bros. fighters). Nintendo Direct showcases are a perfect example of this philosophy: Nintendo led the way with moving their announcements online (innovation), but has actively discouraged co-streaming of the event (trepidation over modern game marketing).

Sega, by contrast, is far more experimental. With Sonic Racing: CrossWorlds, Sega launched a campaign that openly targeted Nintendo’s flagship kart racer, emphasized cross-platform functionality, and incorporated collaborations with franchises like SpongeBob SquarePants, Minecraft, and Pac-Man. This shows Sega is willing to prioritize visibility, influencer partnerships, and even controversy to gain attention. Where Nintendo relies on controlling the narrative, Sega focuses on adaptability: Tapping into new audiences through social collaboration and streaming culture.

_

Nintendo’s current dominance on live-streaming goes beyond game design: It rests on heritage, fan trust, and a brand that streamers and viewers treat as the original standard. While competitors draw interest, they struggle to get out from Nintendo’s shadow…

But this could change. Sonic Racing: CrossWorlds is one such disruptor: With an aggressive marketing campaign targeting Mario Kart World directly and an expansive cross-franchise strategy, the game is working to modernize its appeal. Sega’s kart racer goes beyond copying mechanics and meaningfully differentiates itself from Nintendo, then uses modern game marketing techniques to reach audiences that Nintendo isn’t fully capitalizing on. Building community, streaming-friendly content, and a recognizable identity matter most, giving competitors room to build their own legacy in the coming years.

To keep up to date with the latest insights into live streaming, follow Stream Hatchet and receive exclusive newsletter-only content: