Just a couple of months ago, we explored how publishers and brands could counter inflated live-streaming numbers caused by viewbotting. Since then, the issue has evolved into one of the defining conversations of 2025. As a reminder: In late July, Twitch CEO Dan Clancy announced a new wave of anti-viewbot measures, warning creators that their view counts might drop as detection systems went live. In Q3 2025, Twitch dropped to below 50% market share for the first time ever partially as a result of these crackdowns, as covered in our Q3 2025 Live-Streaming Trends Report. The scale of inauthentic viewership on Twitch was made visible in real time.

Now, we’re taking a closer look at what that shift actually means. In this article, we’re breaking down how successful Twitch’s crackdown was in reducing the number of viewbots on its platform and how it compares to another live-streaming platform: Kick. We’re also deep-diving into a real, current case of viewbotting with MMORPG Knight Online to show you what viewbotting looks like behind the numbers.

TL;DR Takeaways by Stream Hatchet:

- Twitch’s viewbotting crackdown reduced the number of channels with suspicious streams from Q2 to Q3 2025, in some cases by up to 40%

- The viewbotting controversy built steam prior to the crackdown and forced Twitch’s hand, with 48K mentions of “viewbots” in Q1 2025

- A detailed example of viewbotting can be found for Knight Online on Kick, with 42% of all viewership for the game’s top 100 streamers belonging to suspicious channels

Twitch Responds to Viewbotting Discourse with a Crackdown on Bots

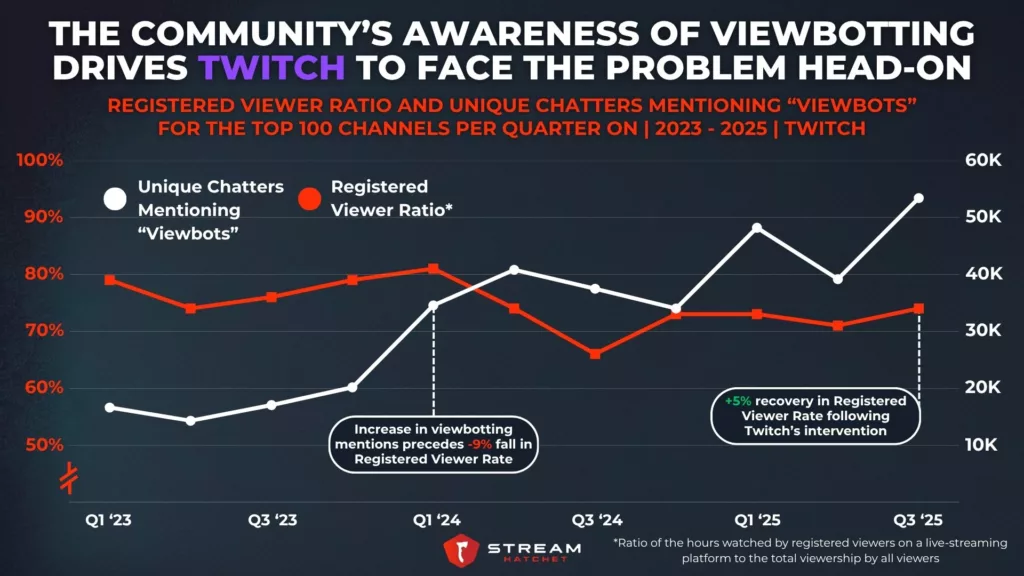

By early 2025, talk of “viewbots” had taken over Twitch chats. 48K unique chatters brought up the issue in Q1 2025 alone: A sign that viewers were growing frustrated with inflated numbers and fake engagement. This rise started back in 2024 though, with mentions steadily climbing as suspicion spread across the community. Streamers, audiences, and advertisers began questioning just how inflated Twitch’s viewership metrics were, putting pressure on the platform to respond. By the time Twitch rolled out its detection update in Q3 2025, the conversation had already turned into one of the year’s defining topics with 53K chat mentions.

We decided to look at how the hubbub about bots matched up with actual viewbotting activity. One way of measuring bots is to look at the Registered Viewer Ratio (RVR): The ratio of the hours watched by registered viewers compared to the total viewership by all viewers. When RVR drops, it means more views are coming from unregistered sources (potentially, bots). That’s exactly what happened at the start of 2024, when the RVR fell by 9% as viewbotting chatter reached its peak. Twitch’s crackdowns have managed to right the ship since then, with Q3 2025 seeing the RVR climb back up by 5%. It’s proof that when platforms act decisively, fraudulent traffic can be curbed.

Twitch Manages to Reduce Suspicious Channels, even as they Rise on Kick

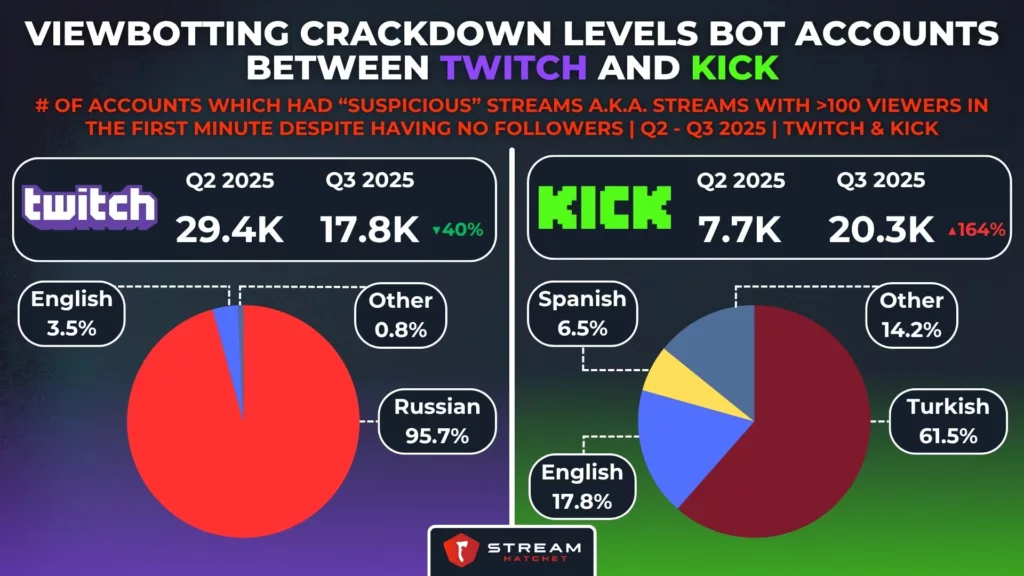

We can see the effect of Twitch’s crackdown using other metrics as well. For our purposes here, we’re defining “suspicious streams” as any stream with more than 100 viewers in the first minute despite the channel having no followers. Between Q2 and Q3 2025, the number of accounts with these suspicious streams on Twitch dropped by 40%, from 29.4K to 17.8K. That’s a major shift in just one quarter, suggesting the platform’s detection systems are catching more inauthentic streams early on. Nearly all of these suspicious accounts (over 95%) were on Russian-speaking channels, showing how localized bot networks can be when exploiting platform loopholes.

While Twitch tightened its defenses, Kick saw the opposite trend. The number of suspicious channels on Kick more than doubled, surging 164% from 7.7K in Q2 to 20.3K in Q3 2025. Turkish-language accounts dominated this suspicious activity, accounting for over 60% of flagged channels, followed by English (17.8%) and Spanish (6.5%). This contrast highlights a growing fragmentation of bot networks: As one platform cracks down, others seem to inherit the problem. Kick in particular faces an uphill battle with viewbotting since, as we’ve discussed, the platform is working hard to clean up its image. So let’s see how this suspicious activity looks in-depth with a real-world example.

An Example of Viewbotting with Knight Online and Kick Channels

Knight Online, a long-running MMORPG with a strong following in Turkey and a growing presence on Kick. It’s also, unfortunately, a frequent target for viewbotting.

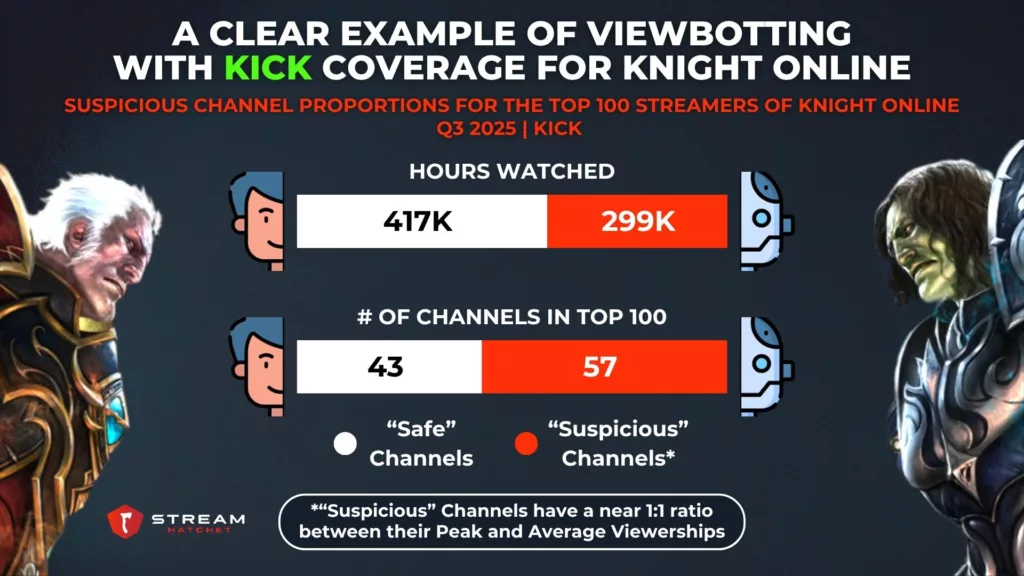

We wanted to show a new method of identifying suspicious channels here, one that’s very effective at quickly identifying odd patterns in viewership. For this analysis, we defined “suspicious” channels as those showing an unnatural 1:1 ratio between their peak viewership and their average viewership. As you can imagine, it’s very rare (virtually impossible) for any stream to maintain a peak viewership from beginning to end without fluctuation. So, armed with this metric, we dug into viewership for Knight Online.

The results are striking. Among the top 100 Kick channels streaming Knight Online in Q3 2025, 57 were flagged as suspicious, representing more than half of all active channels. Those channels were responsible for 299K of the game’s total 716K hours watched among this cohort – roughly 42% of overall viewership. This is a staggering number of hours watched gradually built up by numerous seemingly low-viewership channels. You may think that these channels are just hiding well, but a look into individual channels by a human observer quickly discredits that idea.

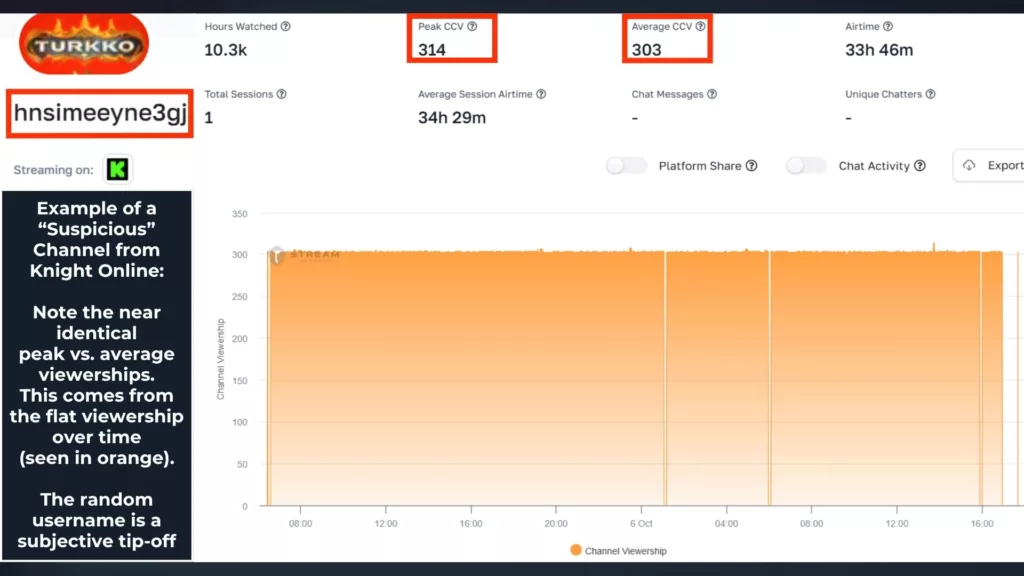

This example from our dashboard shows exactly what a suspicious channel looks like in practice. The account “hnsimeeyne3gj” streamed Knight Online on Kick for over 34 hours straight, yet somehow maintained an almost perfectly flat line of viewership (shown in orange). This is reflected in the channel’s key metrics, with its peak concurrent viewers (314) and average concurrent viewers (303) being nearly identical (giving us that 1:1 ratio mentioned earlier). Real audiences fluctuate naturally, but here, the numbers barely move.

Combined with the randomly generated username and lack of chat activity, it’s clear this isn’t organic engagement. Instead, it suggests a viewbot network designed to keep the stream’s audience count locked at a constant, fabricated level.

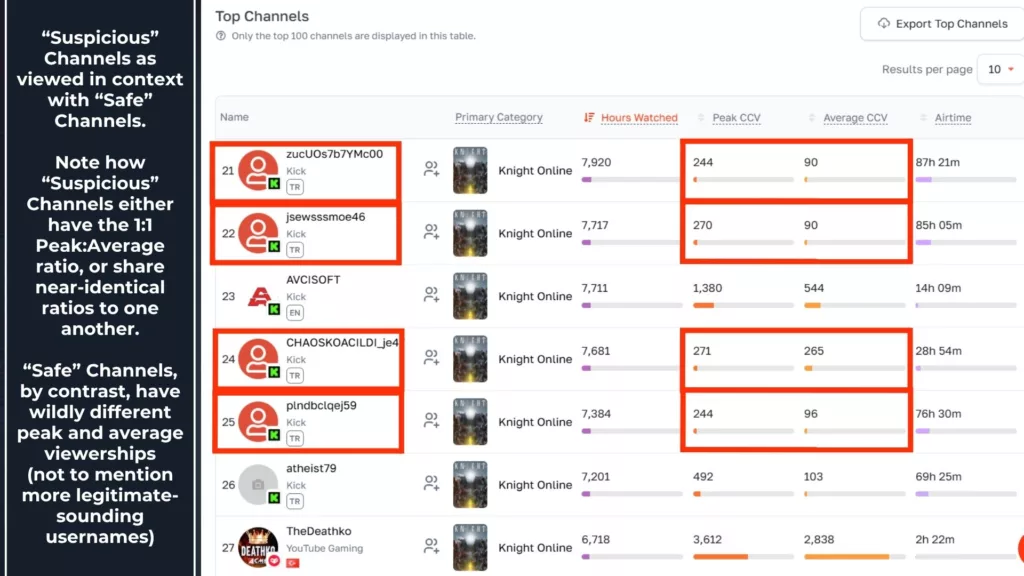

Suspicious channels for Knight Online also stand out for their uniformity. Many of these suspicious channels share near-identical peak-to-average viewership ratios; in the case of the channels shown above, hovering around 250–270 peak CCV and 90–100 average CCV. These carbon-copy statistics are an extremely unlikely coincidence for organic audiences. Combined with random usernames and marathon airtime sessions, these patterns point clearly toward coordinated or automated viewership behavior designed to manipulate visibility.

Safe channels, on the other hand, tell a completely different story. Their peak and average viewer counts vary widely, reflecting the natural ebb and flow of real audiences. Engagement spikes during exciting gameplay or social moments, then tapers off organically. These streamers typically have more authentic usernames, shorter and more varied airtimes, and active chat participation: Clear indicators of genuine human interaction rather than scripted bot behavior.

We want to stress that this case study is only one example; that this isn’t a problem exclusive to Knight Online or Kick: This viewbotting behaviour is replicated across many other titles and platforms to some degree, and may not stem from the titles or platforms themselves.

_

Viewbotting may never disappear entirely, but its influence is shifting. As Twitch’s crackdown showed, meaningful change happens when platforms face public pressure and back it up with clear enforcement. The drop in suspicious channels on Twitch in Q3 2025 proves that action works, either by actual filtering or scaring off viewbotting networks.

But it also reveals how quickly bots adapt, finding new homes on other platforms. For our part at Stream Hatchet, we aim to keep visibility of these viewbotted statistics. Using multiple detection methods, from ratio analysis to behavioral signals, we’re intent on filtering out inflated audiences and spotlighting authentic viewership. That way, publishers, brands, and creators can trust the numbers shaping their next big activations.

For more trends shaping the live-streaming industry in 2025, download our full Q3 2025 Live-Streaming Trends Report now: