Game publishers need more data to figure out which marketing routes are effective for promoting their game, both pre- and post-release. That’s why last month we did a deep-dive into the link between Steam wishlists and live-streaming awareness. Continuing in our quest to demystify the link between promotion and conversions, in this article we’re looking at how streaming can support, or even revitalize, game sales after a game’s full release. We’re happy to be partnering with GameDiscoverCo. once more for their behind-the-scenes Steam data!

To gain some insight into the matter, we’ll be examining some “Perennial Sellers” on Steam, as defined by Ryan K. Rigney over on his substack: “Perennial sellers are premium games (not free-to-play, though they may have live-service elements) with sales curves that seem to never go flat. Many sell thousands or even tens of thousands of copies every week, for years on end.” Using this concept as our jumping-off point, we’re defining our own group of perennial sellers and then looking at how these games have been supported on live-streaming platforms.

TL;DR Takeaways by Stream Hatchet:

- Perennial sellers gain ongoing, proportional support from the live-streaming community

- Prestige is a big deal for perennial sellers: Wins at The Game Awards boost interest even a year after the ceremony

- Big streamers like xQc and Kai Cenat bring new players to games long after their release, but smaller streamers tend to only broadcast to current players (great for community building, less so for sales)

Defining a Sample of Perennial Sellers on Steam

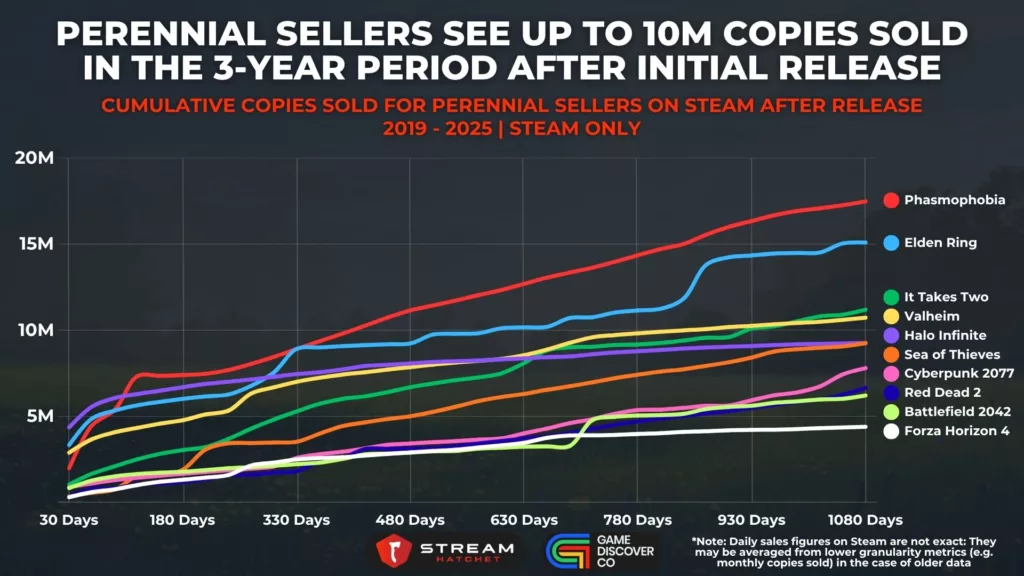

To get our own gauge of which Steam games should be considered perennial sellers, we selected games with the highest average daily copies sold over the three-year period since their release. Of course, since this means we need games that have been out for at least three years, we focused our investigation into games released between 2019 and 2022. We’re also excluding F2P titles since we’re interested in games that make revenue immediately upon purchase. Keeping those parameters in mind, we came up with a top 10 to start us off:

Many of these games should come as no surprise: Out in front we have Elden Ring with 14.2K average daily copies sold in the first three years after its release, with Cyberpunk 2077 (12K) and Phasmophobia (11.5K) also cracking the 10K mark. What is surprising, however, is that this leaderboard isn’t simply flooded with live service games. Although live service games have ongoing content that could consistently attract new players, many of them A) are F2P and B) were released prior to 2019 which excludes them from our analysis (especially mega-popular titles that are now mainstays of the industry).

Perhaps most interesting is how games with limited content (i.e. campaign-focused games) are able to compete with the live service titles that do make it onto this list. Massive open-world RPGs make up the bulk of this cohort, with Elden Ring, Cyberpunk 2077, and Red Dead Redemption 2 hitting the top 5. We’ll look at indie title It Takes Two in more depth in a second, but it feels like a complete outlier as an indie-developed co-op platformer/adventure game.

Taking these 10 titles and looking at their copies sold over time gives us a better idea of how sales are distributed. Naturally, all of these games begin with a rapid rise in copies sold, hitting a shoulder around the 60-day mark and flattening off. For non-perennial games, the slopes would tend towards being practically flat as new sales per day drop into single digits. But these perennial sellers continue to rise, still achieving thousands of copies sold per day and climbing higher. Additionally, this slope doesn’t seem to die off: Though there are some flatter sections, almost all of the games shown ended up resurging during this three-year period.

You’ll also see that many perennial sellers exhibit sudden bursts of interest and jumps in sales. These points are what we really want to dive into: What events drive renewed interest in sales? And are these events based on live-streaming, or amplified by live-streaming in some way? To find out, we’re going to go in-depth on these curves for four of the titles presented:

_

Note here: Older Steam sales data is stored as monthly figures, not as daily figures. The daily figures are estimated by evenly distributing these monthly totals, so daily figures are often an approximation. Put simply: We can’t be too specific about events on certain days affecting sales data (news releases, updates, new content). But our live-streaming viewership data is more granular and can point us in the right direction.

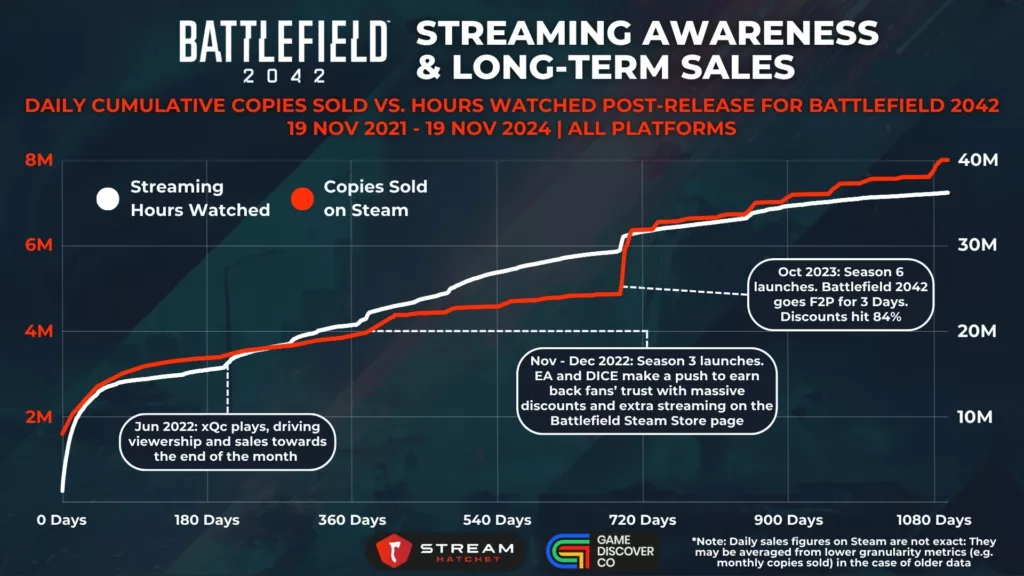

Battlefield 2042 Leverages Streaming and Discounts to Change Public Perception

Battlefield 2042 is a AAA live service title: Exactly the kind of game we’d expect to be a perennial seller. Yet the game was negatively received upon first release: How did a game that was initially panned manage to become one of the top perennial sellers in our sample?

Estimated “Hours Watched:Copies Sold” Ratio = 5:1 (we’ll be providing this ratio per game to give you a rough indicator of how many hours watched translate to how many copies sold).

June 2022: Roughly half a year after its initial launch, game sales were trailing off and we can see the sales curve flattening. The first time this trend reverses is thanks to some much-needed exposure from a big-name streamer. xQc hosted a Battlefield 2042 stream with 223K hours watched, bringing Battlefield 2042 to a wider audience and showing off some of the improvements to the title post-launch. In the same month as xQc’s stream, ~150K copies were sold, up from just ~30K copies sold in the 30-day period prior.

November – December 2022: On the game’s one-year anniversary, EA makes a move to reverse online perception of Battlefield 2042 alongside the release of its Season 3 launch. Streamers get excited for these updates, with a lift in viewership in November 2022. Developer DICE then chats to PC Mag in December, spreading the message that they’ve rectified many of the missteps of the game’s launch and hope players will give the title a second chance. This positive PR push coincides with increasing discounts as high as 84% off, all of which leads into…

October 2023: Alongside Season 6, EA makes one last push to get new players onboard with a 3-day free access period, where curious gamers can try out the game with no strings attached. As you’d expect, “sales” skyrocket here with about 1.4M copies “sold” over this period (but you might want to exclude those numbers since they’re essentially F2P numbers). What is encouraging here is that the slopes of both live-streaming interest and copies sold increase after this period, showing that this free access period had a long-term effect on sales. There’s a caveat here though: That initial jump in streaming viewership is inflated by the Steam Store page generating 622K hours watched (an effect we’ve previously discussed here).

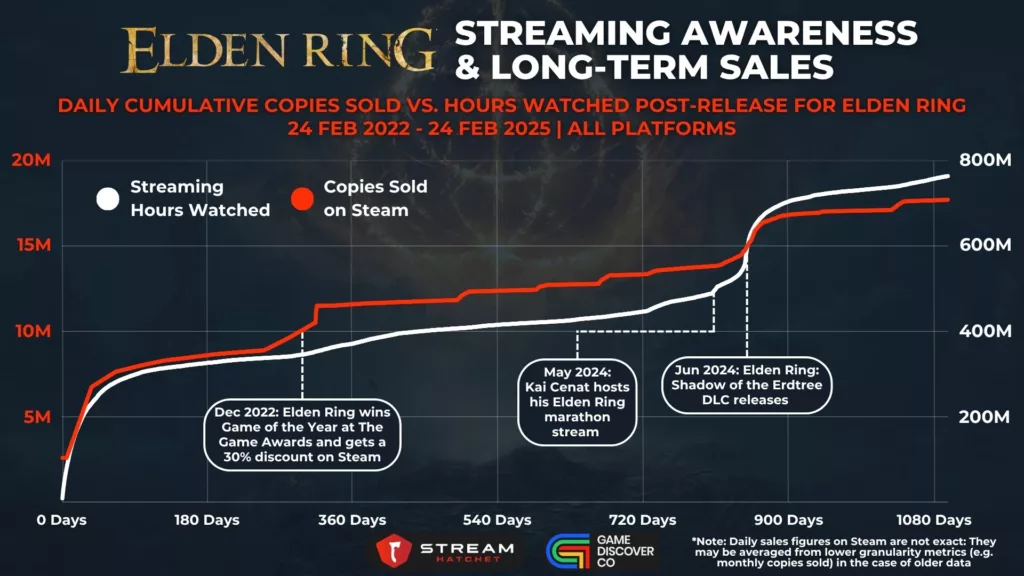

Elden Ring’s DLC Gives Streamers a Reason to Prop Up the Title

Elden Ring is another AAA game, but as an RPG, one wouldn’t usually expect it to keep selling content long after release. The game’s open world, series legacy, and the general popularity of Souls-likes on live-streaming helped to break this stereotype and led to the game’s enduring legacy. Let’s take a closer look at how Elden Ring became a perennial seller post-release.

Estimated “Hours Watched:Copies Sold” Ratio = 40:1

December 2022: Elden Ring shot off in the beginning, quickly selling over 7.5M copies in its first 90 days. But we can see the sales curve flatten off as expected for an RPG as audiences chew through the content. It’s not until December of that first year that Elden Ring got a second chance in the limelight as the winner of Game of the Year at The Game Awards. At the same time, a 30% discount for the game converted a backlog of wishlisters into customers. Sales jump, and live-streaming interest begins to build again, setting the standard that Elden Ring can maintain enduring popularity.

May 2024: One of the reasons Elden Ring was able to keep sustaining interest with limited content was the online community’s invention of unique challenges for beating the notoriously difficult game. From limited runs to speedruns to SuperLouis64 who played the entire game on a banana, streamers were able to keep milking content from this open-world epic. No streamer better exemplifies this trend than Kai Cenat, whose May 2024 marathon of the game allowed it to reach the largest possible live-streaming audience.

June 2024: Just a month later, Elden Ring’s Shadow of the Erdtree DLC released to rapturous support by gamers and sparked off a second wave of interest in the title. Perhaps helped by the lead-up of Kai Cenat’s marathon, 2M more copies of the base game were sold despite pundits fearing that the RPG audience had been entirely tapped out from the game’s initial hype. Amazingly, live-streaming viewership actually accelerates after this time for at least the next 180 days, flying in the face of expectations for RPGs.

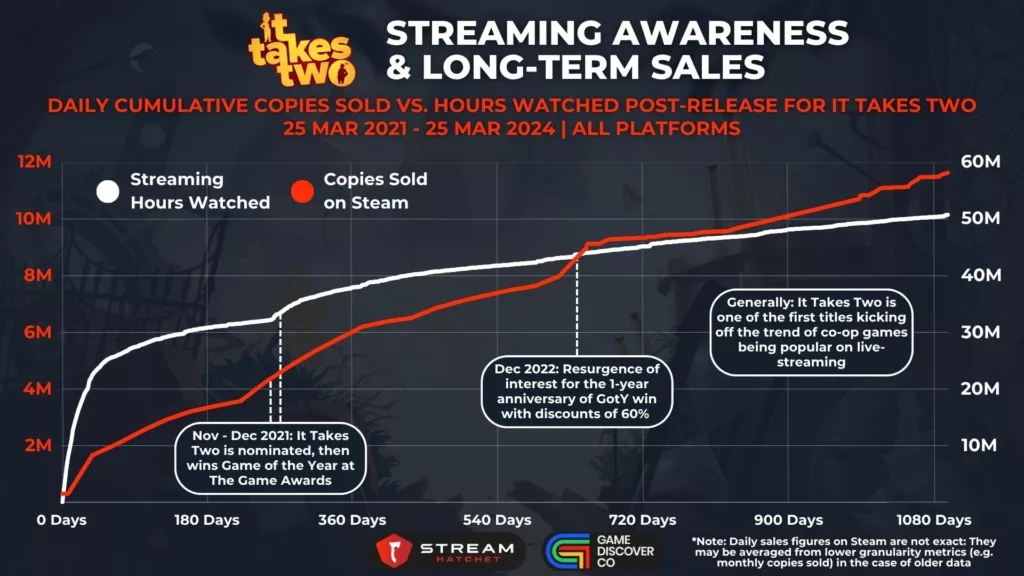

It Takes Two Rides its Critical Prestige to Long-term Popularity

Switching gears, we wanted to look at some indie titles to see if the effect of live-streaming was as pronounced post-release for games that frequently have much smaller marketing budgets. It Takes Two feels like a great starting point, being an unusual genre for perennial seller status but somehow ending up with close to 12M copies sold on Steam in 3 years. Note that Friends Pass “sales” may inflate the numbers here a little bit, however.

Estimated “Hours Watched:Copies Sold” Ratio = 5:1

November – December 2021: Just like Elden Ring, It Takes Two got a chance to shine thanks to winning Game of the Year at The Game Awards. Taking these two examples together suggests that one of the key ways to achieve perennial seller status is prestige: Critical acclaim embeds you in conversations amongst gamers and will keep your title being mentioned again and again long after release. Additionally, the live-streaming community in particular has a close association with commentary for The Game Awards.

December 2022: Things aren’t so clear after this award win, however. New customers steadily dripped in over the next year without pause, perhaps reflecting the gradual word-of-mouth promotion necessary to convince players to buy the game. This word-of-mouth promotion may also explain why the one-year anniversary of the game’s GotY win saw another spike in attention, with blogs and outlets writing thinkpieces and a Switch port boosting the game’s profile. Three back-to-back discounts of 60% each also helped lower the barrier to entry for curious customers who wouldn’t normally pursue this type of game.

Generally: Frequent discounts continued through the rest of It Takes Two’s first three years, continuing to drive sales. Thanks to this notoriety, Co-op games gained wider adoption on live streaming as we’ve covered previously, including recent high-performers like Peak, Chained Together, and Lethal Company. This long-term boost to genre popularity came full circle in 2025 with the successful release of Hazelight’s latest title Split Fiction.

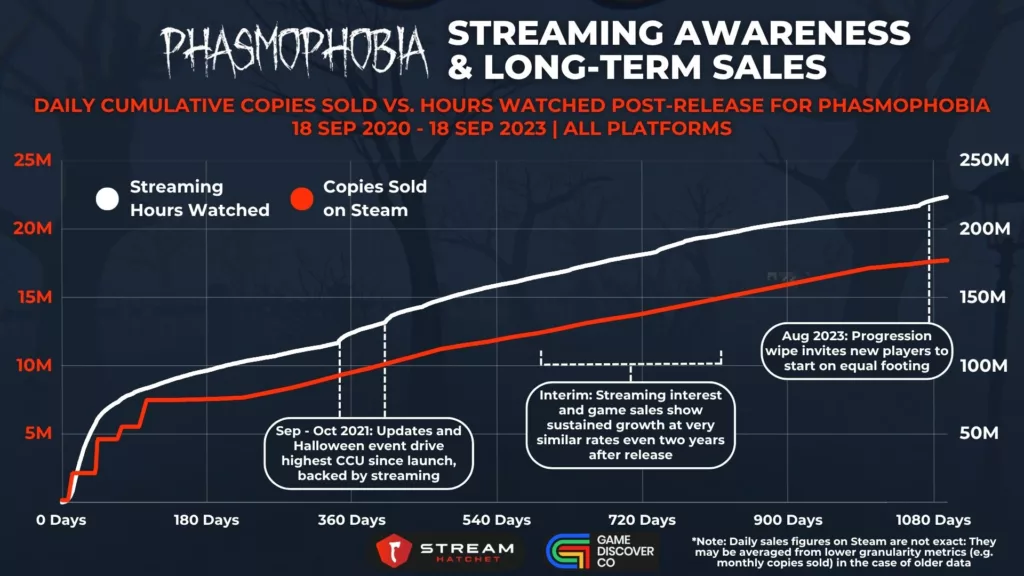

Phasmophobia’s Gameplay Loop is Catnip for Online Communities

Phasmophobia falls neatly into the “live-streaming” friendly bucket, being a multiplayer horror game. However, as it’s still an indie title, it’s interesting to see how Phasmophobia was able to capture online attention without a series legacy behind it (as we’ve touched on in the past for a range of indie games).

Estimated “Hours Watched:Copies Sold” Ratio = 14:1

September – October 2021: In the game’s first full year from release, it quickly established itself as an enduring title. After just one year, 9.5M copies had been sold and 125M hours had been watched on live-streaming. Keep in mind, there’s an element of timing to this initial reception: Phasmophobia launched in the middle of the COVID pandemic, meaning it was able to provide a social outlet to disconnected friends and hit the widest possible audience. All of this culminated in the one-year anniversary Halloween event which introduced Nightmare mode to the game.

Interim: Phasmophobia is the online community’s dream game, taking lo-fi horror and turning it into a multiplayer experience with voice chat. It’s extremely clippable, and kicked off a wave of similar titles like R.E.P.O., Lethal Company, and Content Warning. Having social sharing built into the game’s premise is the key to Phasmophobia’s perennial seller status. For practically the entire 3-year stretch examined, the game consistently pulled in hundreds of thousands of hours watched every single day on live streaming, with correlating consistent sales.

August 2023: Streaming interest for Phasmophobia saw another slight bump towards the end of the examined period when the developers made the bold move to completely reset all players’ progression. This blank slate caused controversy among veteran players who felt like their save files were being deleted. But this strategy is a tried-and-tested way to make an older game more accessible for curious new players. Take Rust, for example, which frequently sees a boost in playership (and viewership) when it resets its servers. Though cut off in the graphic above, this tactic provided another small sales boost.

_

As noted in our last article, the cause-effect relationship of streaming awareness and game discovery is confounded by so many factors. However, the games we’ve looked at here support the idea that streaming amplifies the reach of new content and accolades that games receive post-release. Streaming is a natural place for conversation around these titles to flourish among gamers, renewing excitement online.

The effect does, however, seem to be stronger for AAA games titles which can spark interest with marketing pushes, while indie titles tend to rely on streaming to boost sales prior to and just after release. Additionally, there are many effective non live-streaming options for boosting sales that are well-recognized in the game discovery community, such as heavy discounts, F2P periods, and critical acclaim.

If you’re interested in more insights into console and PC game discovery, check out the amazing work by GameDiscoverCo. and keep in touch with them via their newsletter!

To keep up to date with trends connecting streaming and game discovery, follow Stream Hatchet and receive exclusive newsletter-only content: