Game publishers need more data to figure out which marketing routes are effective for promoting their game, both pre- and post-release. That’s why we’ve recently been deep-diving into a range of topics linking live-streaming and Steam data, thanks to the help from our friends over at GameDiscoverCo.!

We’ve looked at Steam wishlists and perennial sellers before, but this time we’re looking at one of the most common release strategy concerns for every publisher: Early access. Do you need it, and if you do run early access, how long do you run it for? In this article, we’re looking into a host of popular games released since 2024 to look at the correlation between their live-streaming viewership and their early access strategies (plus some extra wishlist data to show how this awareness translates into potential sales!)

TL;DR Takeaways by Stream Hatchet:

- Games with Short Early Access periods of 1 week or less see their highest daily viewerships in early access, not upon full release

- Games with No Early Access period are more likely to flatline in both streaming viewership AND wishlists within their first 30 days after release

- Games with Long Early Access periods of more than 1 week show bumps in viewership and wishlists from early access release and their official launch

Defining Three Main Types of Early Access Strategies

Broadly speaking, there are three common early access strategies amongst most publishers:

–

No Early Access: Keeping it retro, these games avoid early access altogether and jump straight into a full release. These games are usually AAA titles and rarely live service.

Games include: Dragon’s Dogma II, Final Fantasy VII Rebirth, Monster Hunter Wilds, Metaphor: ReFantazio, Assassin’s Creed Shadows, Clair Obscur: Expedition 33, Like a Dragon: Infinite Wealth, Tekken 8

–

Short Early Access: The modern standard, these games have a 1-week or less period where sponsored streamers or people who pay for a premium version of the game can play it ahead of official release.

Games include: Warhammer 40,000: Space Marine II, Dune: Awakening, EA Sports FC 26, Silent Hill f, NBA 2K25, Metal Gear Solid Δ: Snake Eater, Suicide Squad: Kill the Justice League, Dragon Ball: Sparking! ZERO

–

Long Early Access: Populated by indie titles, these games can sit in early access for months or even years as changes are made, bugs are fixed, and fans are found before their official launch.

Games include: Abiotic Factor, Backpack Battles, Blood Strike, Deep Rock Galactic: Survivor, Enlisted, Hades II, SUPERVIVE, Supermarket Simulator

–

We selected 8 games that fall into each of these 3 categories (as noted above) and compared their live-streaming viewership during their early access launch vs. their official launch.

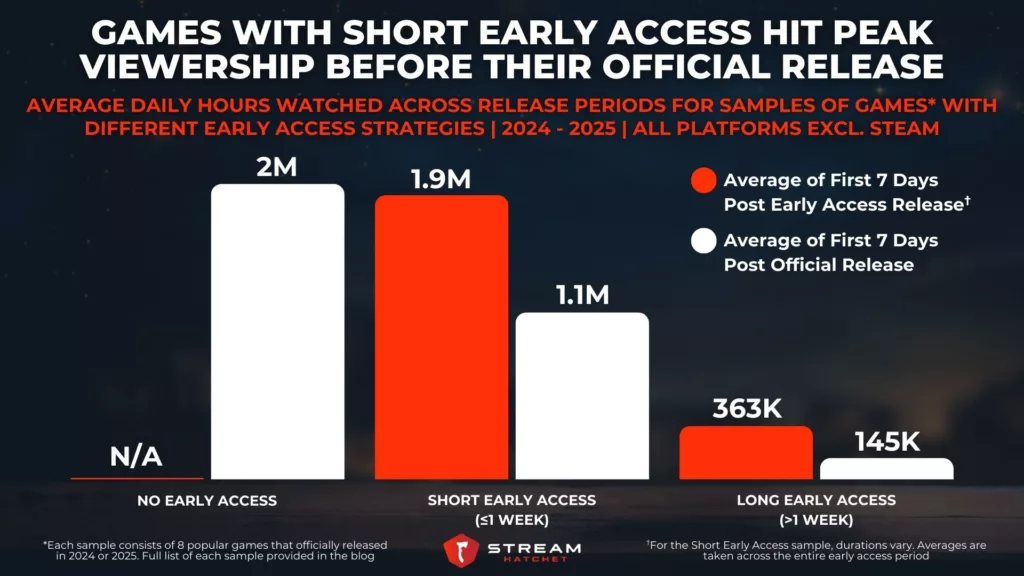

Looking across the three categories, the No Early Access sample comes in first with 2M average daily hours watched in its first 7 days (averaged across the 8 games in the sample). This makes sense of course: For these games, this is the first chance for viewers to see it and so all of their attention is focused in one place. However, we see a very similar average daily hours watched for the Short Early Access sample during the period after the game releases into early access. In other words, the early access release date essentially functions as the premiere for these games, with viewership dropping by almost 50% for the official release date.

Lagging way behind are the Long Early Access games, which don’t seem to get as much love either upon early access release (363K) or on official release (145K). This is no doubt due to most Long Early Access games being indie titles: Without pent-up hype to drive interest, there’s not as large of an audience desperate to watch these games when they first come out. What is weird, however, is that the official release period is still lower than the early access period. Given that these games are all successful titles, one would expect the Long Early Access strategy to be capped off by a large premiere. We’ll see below why this might not be the case for games in this sample.

No Early Access Makes for Big Launches, But Lackluster Follow-up

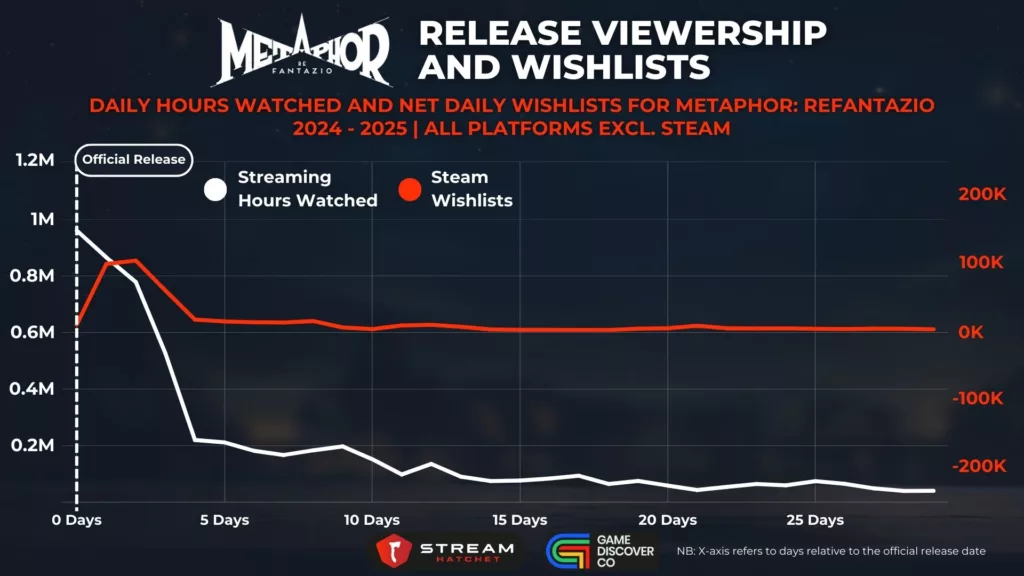

To get a better understanding of what these samples actually contain, we’re going to look at some specific games from each sample and see how their viewership and wishlists change over time. First up, we have the No Early Access games which forego an early access period altogether. Instead, they rely on the prestige of their series’ IPs or the reputations of their publishers/developers to drive interest upon official release.

Metaphor: ReFantazio comes from the minds behind the Persona series and, as their first adventure in an entirely new world, the game had a lot of hype behind it. The game saw the bulk of its live-streaming viewership in its first couple of days, with wishlists spiking at the same time. However, at almost the same rate, both viewership and wishlists died off. As a mechanic-heavy JRPG, the audience for Metaphor: ReFantazio seemed to be tapped out fairly quickly, and it wasn’t until its nomination at The Game Awards later that year that another wave of players adopted the game.

RPGs and JRPGs are classic examples of AAA genres that generally avoid early access: These games depend on curiosity about their stories and their worlds to drive interest, so spoiling this prior to release with gameplay of extensive tutorials can actually hurt sales. Among this sample, we see similar viewership/wishlist curves for Clair Obscur: Expedition 33, Like a Dragon: Infinite Wealth, and Assassin’s Creed Shadows: All of these games saw large spikes in their first few days, then interest quickly died off.

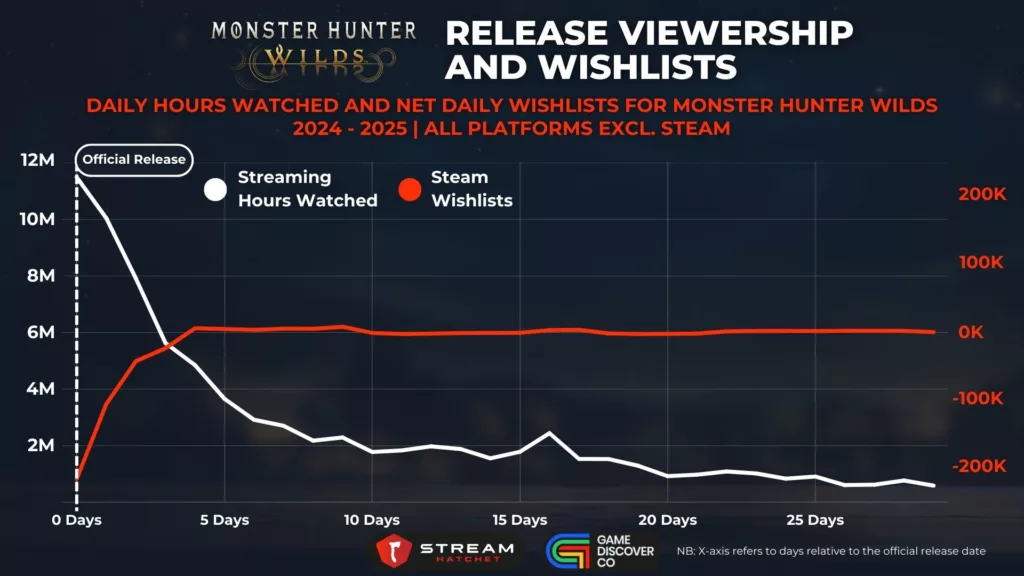

There are exceptions to this rule for No Early Access games, however. Monster Hunter Wilds, for example, actually saw a massive drop in net wishlists upon debut, even though it saw 10x the hours watched of Metaphor: ReFantazio. There are a couple of reasons for this: Firstly, drops in wishlists are also triggered by sales. So negative wishlists here are more likely the result of many purchases, based on the phenomenal commercial success of the game.

Secondly, an aggressive marketing campaign prior to release helped secure wishlists early on and so there were likely less potential buyers from which to generate wishlists. Put more simply, some AAA titles earn their awareness long before release and reach a kind of “wishlist saturation”. Regardless, just like the other No Early Access games mentioned, wishlists then followed the same pattern of tapering towards zero net daily wishlists after just a few days.

Short Early Access Spreads Out Interest, But Doesn’t Make Sense For Every Game

Short Early Access games hold a brief early access period designed to capture the interest of streamers and hardcore fans, helping to showcase some of the gameplay prior to the official release. These games have something to prove, and want to stir up word-of-mouth discourse before release… but does this strategy actually drive wishlists?

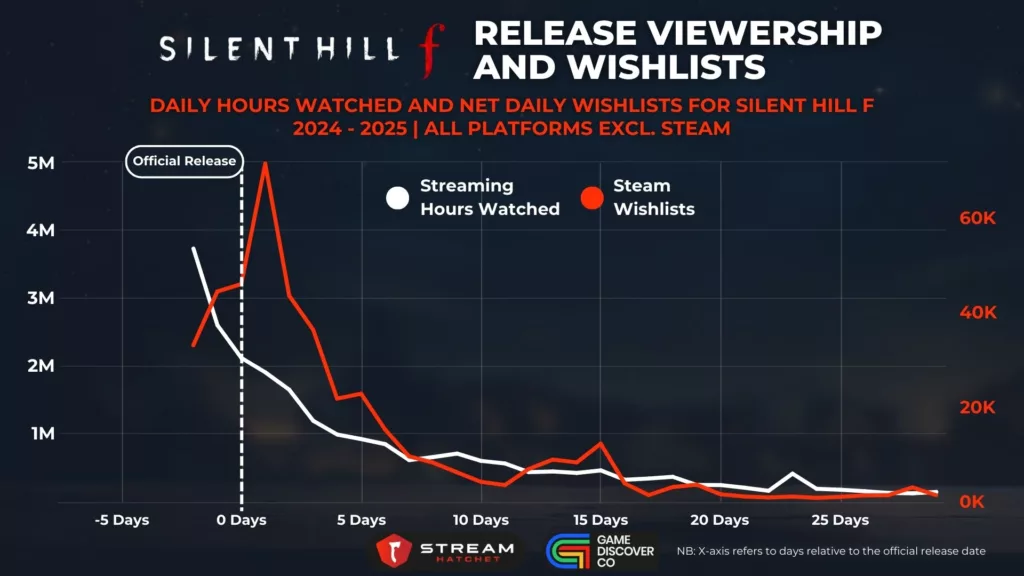

Silent Hill f was a return to a long-dormant franchise, and Konami was keen to give interested players a sneak peek of the game just a couple of days ahead of its official release. In these two early access days, Silent Hill f had its highest viewership which then consistently decreased from there. But this awareness push worked: That first day saw 34K wishlists generated on Steam, which mounted to a peak of 72K net daily wishlists the day after release. Silent Hill f is perfect for live-streaming as a AAA horror title with enough atmosphere to tempt curious onlookers into watching. Giving it an early access period was a smart strategy to attract new fans to this returning series.

Many of the Short Early Access games in this sample followed similar curves: Their highest streaming viewership would happen during early access, which would kick off some wishlists before spiking in wishlists the day after release. This pattern represents a wave of early access streamers encouraging other streamers to try the game upon release, which magnifies the effect of the initial early access period and leads to a boom in wishlists. Games from our sample that followed this pattern include Metal Gear Solid Δ: Snake Eater, Dragon Ball: Sparking! Zero, and Dune: Awakening.

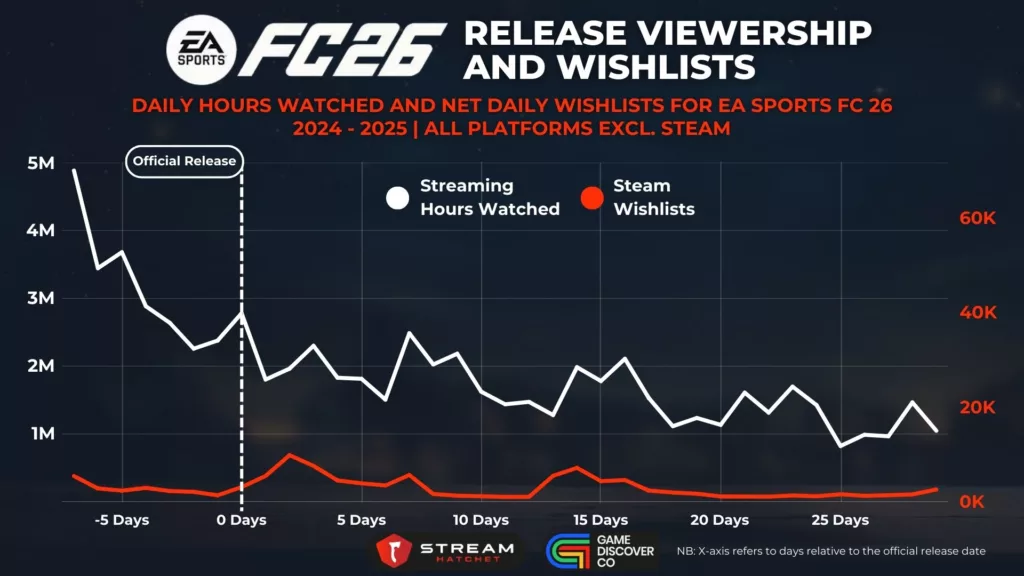

While this effect from Short Early Access looks promising, it’s not the best fit for every game. Take EA Sports FC 26, for example: The game saw consistently high viewership across its early access period and its first 30 days, taking much longer to fade than many of the other games in this sample. However, this interest didn’t seem to translate into wishlists, with net daily wishlists staying mostly flat across the same period. So what gives?

EA Sports FC 26 is practically the opposite of Silent Hill f in terms of reputation: This is a series which has hardcore, baked-in fans who will turn up for each year’s new entry based on IP recognition alone. With so many games behind it, early access periods aren’t really necessary to see what the game is about: Fans know what an EA Sports FC title is going to look and feel like, and they’re already bought in. Additionally, many of these legacy fans of the series may be more likely to buy EA Sports FC 26 on console rather than PC, which also puts a dampener on wishlist numbers.

Long Early Access Periods Suit Indie Games Looking to Build Loyalty

Long Early Access games are accessible to the public during their development so that their publishers/developers (typically indies) can farm feedback from the community. The drawback here is that many of these games can be trapped in early access for years on end (like Escape from Tarkov).

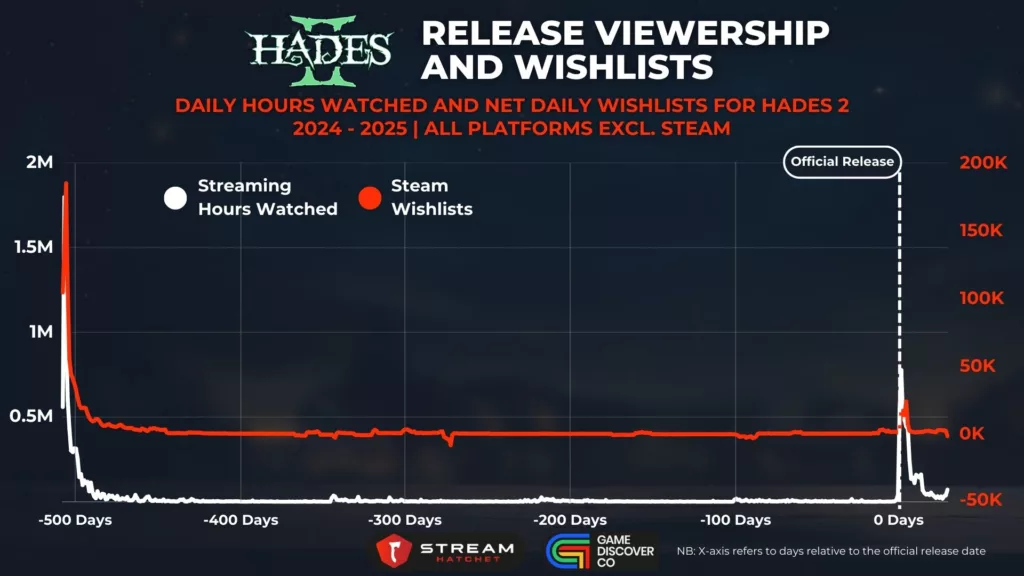

Hades 2 is the follow-up to 2020’s Hades: A critical and commercial indie darling which earned a fanbase that eagerly awaited the release of its sequel. As such, when Hades 2 released into early access, both viewership and wishlists skyrocketed (with net daily wishlists hitting 185K shortly after release). Both streaming interest and wishlist generation then tapered off until the game’s official release, which again saw spikes in both metrics (but of a far smaller magnitude than before). Still though, this second wave saw a peak of 23K wishlists correlating with streaming interest – nothing to sneeze at!

This flat period during early access is a defining characteristic of Long Early Access games, bookended by spectacular early access releases and more subdued official releases. With these being indie games, there are scant resources to run big marketing pushes during early access, and so awareness pushes tend to centre on just these two release periods. Games in our sample that followed this pattern included Abiotic Factor, Backpack Battles, SUPERVIVE, and Deep Rock Galactic: Survivor.

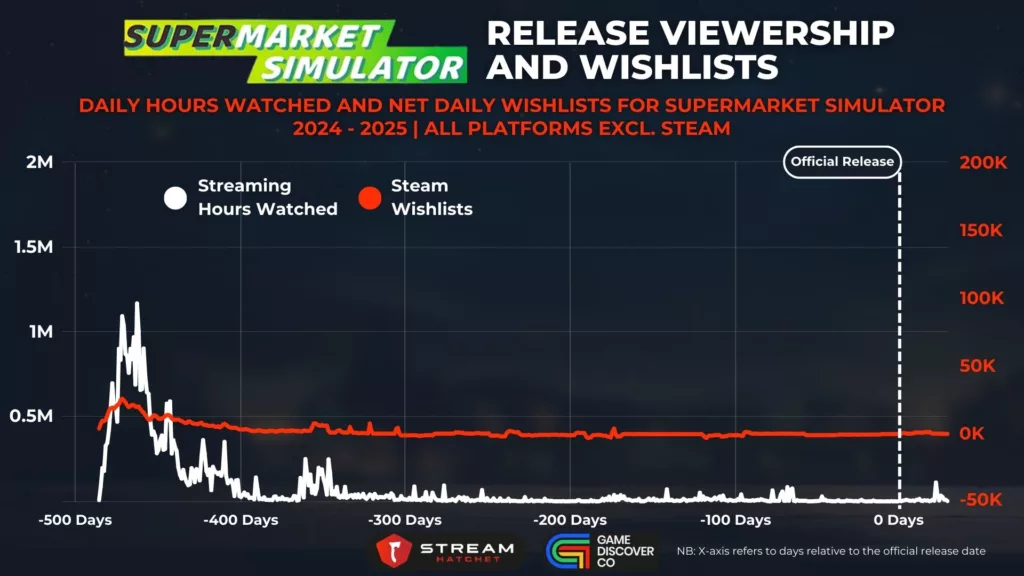

There’s a risk to abandoning marketing altogether after a game’s early access launch, however. Take Supermarket Simulator, for example: This game had a ton of hype when it first released, dominating the front pages of Twitch and YouTube and sustaining hundreds of thousands of hours watched every day for the first 3 months following early access release. Coinciding with this success, the game was bringing in over 10K net wishlists every day for a solid month, which is an incredible performance for a game with no pre-existing IP.

But then interest went flat: People burned out on Supermarket Simulator’s rewarding but simplistic gameplay loop. Viewership dropped, net daily wishlists turned slightly negative, and the game stagnated. While other Long Early Access games saw a revival upon their official launch, Supermarket Simulator saw nothing. There are two main possible reasons for this:

- As a low-res game, the official release had little to offer beyond what was already available (and enjoyable) during the game’s early access period.

- A wave of copycat Simulator games may have eaten away at Supermarket Simulator’s share of the market and diverted attention away from its official release.

_

In essence: The long duration between early access launch and official release allowed interest to wane for a title which had taken streaming by storm.

_

As noted in our other articles using Steam data, the cause-effect relationship of streaming awareness and game discovery is confounded by so many factors. However, the games we’ve looked at here show that streaming is crucial for certain games hoping to employ early access strategies. Take indie games with Long Early Access periods like Hades 2, for example, which saw significant bumps in wishlist numbers alongside streaming interest.

However, games that have large, in-built fanbases like EA Sports FC 26 don’t seem to get much wishlist benefit from streaming interest, despite having massive followings on platforms like Twitch and Kick. There’s also the risk that an extended early access period can dissuade players from purchasing the game due to burnout or high negative sentiment. Hopefully some of the insights provided here will help you to make a more informed decision on which early access strategy you take on, but with so many nuances it can be better to speak to an expert in the streaming space instead.

If you’re interested in more insights into console and PC game discovery, check out the amazing work done by GameDiscoverCo.!

To keep up to date with the latest tips and tricks for generating game awareness on streaming, follow Stream Hatchet and receive exclusive newsletter-only content: