The Korean live-streaming scene has finally settled into a stable rhythm after the disruption caused by Twitch’s shutdown back in February of 2024. New platforms have formed, old platforms have rebranded, and streamers have found ways to ride this wave of attention to reach new audiences. Although we discussed the situation in Korea when the news first broke, we felt that it was worth revisiting the topic one year on to see who were the big winners out of this shake-up and what kinds of content are appealing to this section of the industry.

In this article, we’re looking at the top games and streamers on Korean streaming platforms, including their performance against one another and the position of Korean game publishers in this space.

SOOP Korea and Chzzk Grow As Competitor Twitch Leaves South Korea

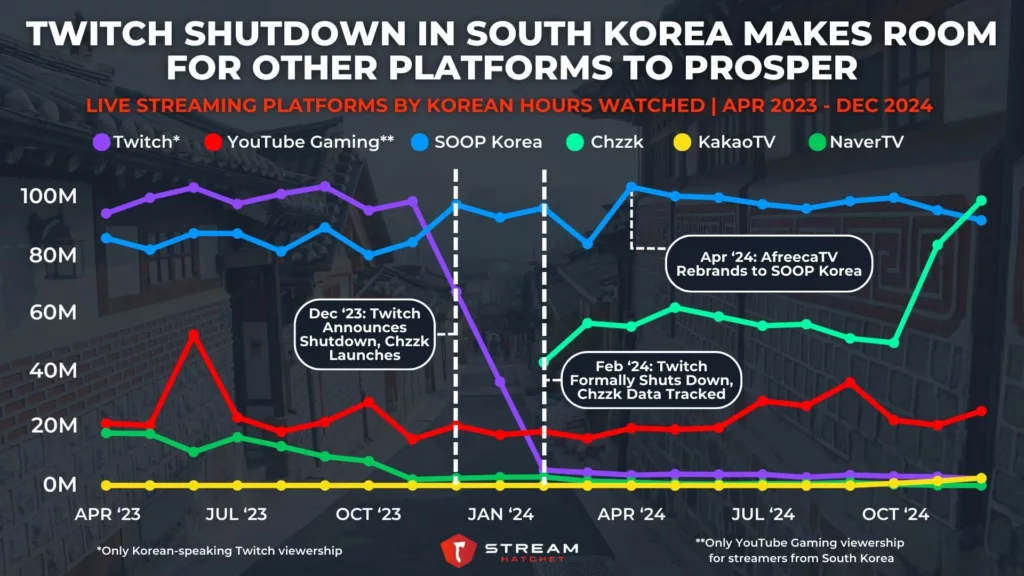

Twitch’s shutdown took place over roughly a two-month period, from the announcement of the shutdown in December of 2023 to the official shutdown in February of 2024. Before this announcement, Twitch’s Korean-speaking viewership outperformed even that of local platforms at ~100M monthly hours watched (compared to ~85M monthly hours watched for AfreecaTV over that same period). After the shutdown, Twitch dropped to just ~4M monthly hours watched, leaving a massive void of 95M monthly hours watched for other platforms to snap up. The three main contenders for this viewership were YouTube Gaming, SOOP Korea (the rebranded form of AfreecaTV), and newcomer Chzzk.

Chzzk, a Naver-backed platform launched in December of 2023, emerged as the big winner from Twitch’s shutdown. The platform was custom-built to pick up Twitch’s viewership, featuring a similar UI and category names. The strategy paid off, with Chzzk seeing 43M hours watched in February (just over a full month after the platform launched). Since then, Chzzk has continued to grow and at the end of 2024 saw two consecutive months of far higher viewership, even beating out SOOP Korea in December of 2024 with 100M hours watched. SOOP Korea (née AfreecaTV since April of 2024) is still performing as strong as ever, having attained higher monthly hours watched in 2024 compared to 2023 after splitting off its (much smaller) non-Korean viewership into SOOP Global (explained in more detail here).

While the increased viewerships on SOOP Korea, Chzzk, and YouTube Gaming would suggest that live streaming is stronger than ever in Korea, that’s not quite accurate. Twitch’s departure also meant the departure of less committed viewers and streamers, who clearly took the opportunity to shift their focus to other forms of entertainment and/or employment. In all, the average Korean hours watched across all platforms dropped by 16% from 2023 to 2024: It’ll take a bit longer for the Korean live-streaming industry to recover. One might have expected YouTube Gaming to pick up more of the slack here with so many other Asian countries (Japan, Thailand) streaming on the site – but Korean audiences still seem loyal to their locally-hosted platforms.

Popular Games on SOOP Korea and Chzzk

SOOP Korea’s streaming community has a select few types of content that capture the bulk of their attention. Aside from Social content (SOOP Korea’s equivalent of Just Chatting), the top three categories by hours watched in 2024 are all games: League of Legends (195M), Minecraft (139M), and StarCraft (125M). While the first two titles have global popularity, StarCraft’s enduring popularity is a uniquely Korean phenomenon tied to the origin of esports in the region. IRL content also has a strong presence on the platform, with Travel and Mukbang content bringing in 27M and 15M hours watched, respectively. For the uninitiated, Mukbang is another uniquely Korean staple on live streaming in which streamers eat (and typically binge eat) on camera in a kind of via-video feast.

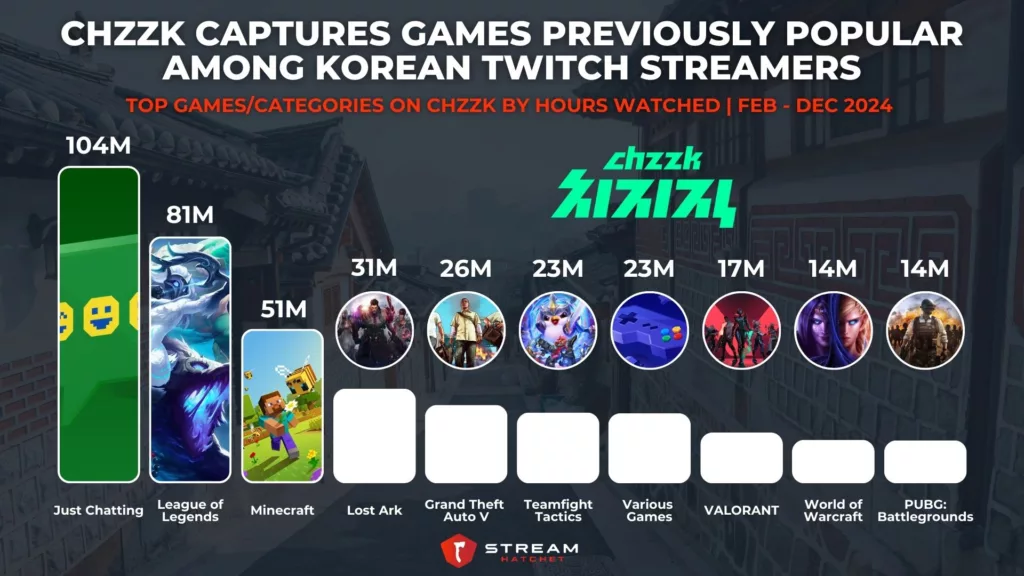

Chzzk shares some similarities with SOOP Korea, namely the popularity of Just Chatting, League of Legends, and Minecraft content. But beyond these similarities, the types of games finding success on Chzzk in 2024 are more similar to those watched on Western platforms, including Grand Theft Auto V (26M), VALORANT (17M), and World of Warcraft (14M). MMOs are also central to Chzzk’s community, including the locally-developed Lost Ark and Black Desert Online. Finally, the dedication to Riot Games is evident with League of Legends, Teamfight Tactics and VALORANT all making it into the top 10. Brands used to marketing via popular content on Twitch should therefore consider supporting equivalent content on Chzzk to reach Korean audiences.

Popular Streamers on SOOP Korea and Chzzk

Streamers in Korea, known as “Broadcast Jockeys” or “BJs”, are key tastemakers for new game launches. The top streamers mentioned below frequently make it into the top 10 streamers worldwide for high-profile game releases on streaming, making accessing their audience essential for any AAA developers hoping to tap into a Korean audience. In the case of SOOP Korea, this includes StarCraft esports pro 봉준 (Kim Bong-jun) with 67M hours watched and League of Legends / variety streamer 김민교. (Kim Min-kyo) with 58M hours watched over the past 12 months. SOOP appeared to retain the old guard of AfreecaTV even with its modern rebrand.

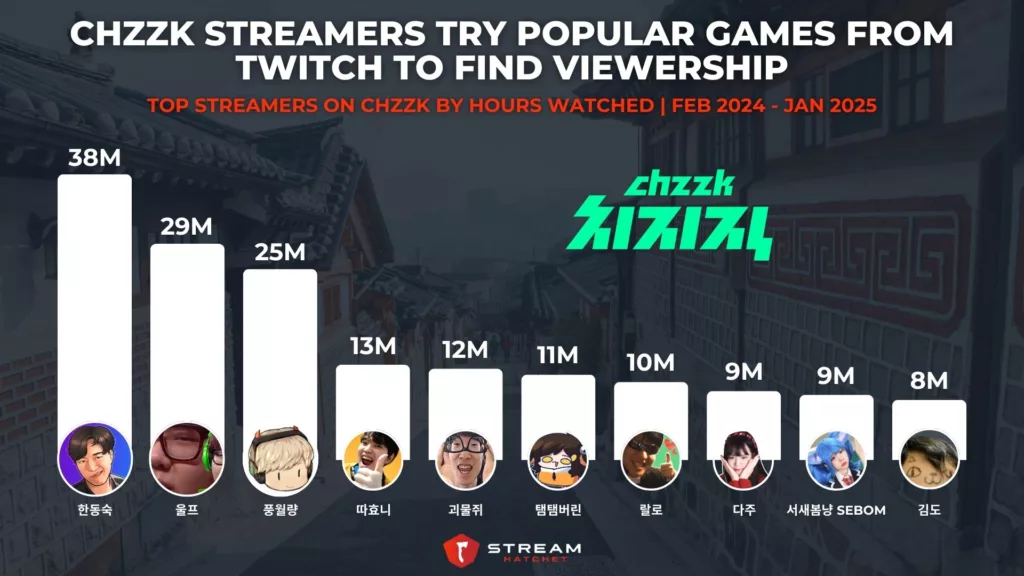

Chzzk, conversely, became a fertile breeding ground for new talent that hoped to break into the industry during the shake-up of Twitch’s shutdown. This was, of course, in addition to its role as a refuge for Korean-speaking streamers that had to abandon Twitch (covered more here) with the familiarity of the platform’s UI making the space feel like a more comfortable option than SOOP Korea (which, at the time, had an outdated UI from its status as AfreecaTV). Chzzk scooped up some big names in the transition, including creators who consistently try out AAA game releases like 한동숙 (Han Dong-sook) and 풍월량 (Poong Wol-ryang) with 38M and 25M hours watched, respectively.

Korean Publishers Ride the Wave of Interest in Locally Produced Games

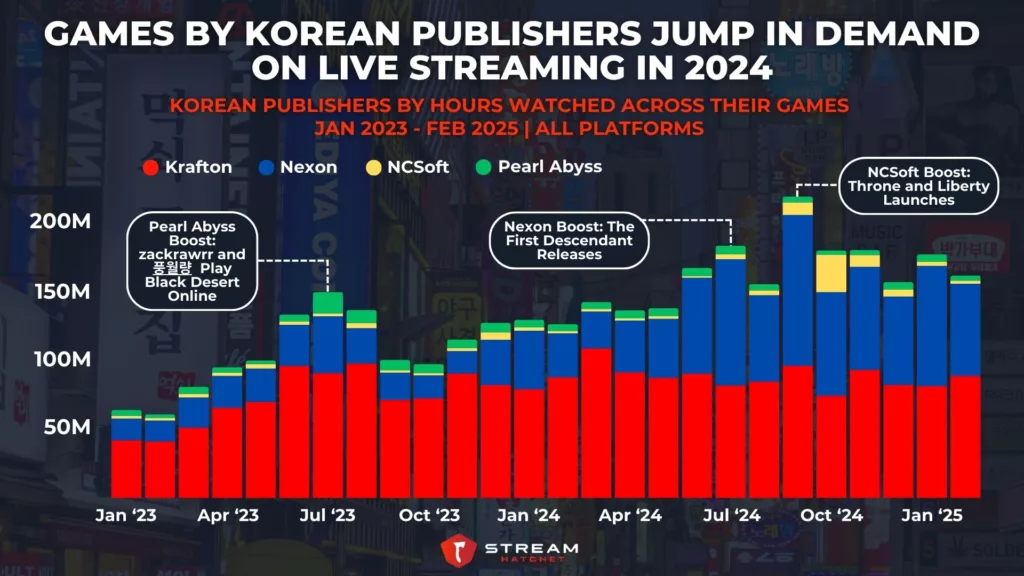

One interesting beneficiary of the Twitch shutdown in Korea is Korean game publishers, who seem to have seen a rise in demand. From 2023 to 2024, the yearly hours watched of games published by four major Korean game publishers (Krafton, Nexon, NCSoft, and Pearl Abyss) increased by 52% from 106M to 162M hours watched. This increase in demand matches the increased interest in Chinese-published games that we’ve covered previously, best exemplified by the overwhelming success of Black Myth: Wukong.

The big winner here is Krafton, which has found global success with both PUBG: Battleground and its mobile variant PUBG Mobile. Krafton’s games tend to find more demand outside of Twitch, with 8% of all Krafton’s viewership coming from SOOP Korea and 57% from YouTube Gaming in the second half of 2024. Compare this to NCSoft whose recent title Throne and Liberty almost entirely depended on Twitch to generate viewership over the same period (95%). Nexon landed somewhere in the middle, with 5% of their entire viewership coming from SOOP Korea and Chzzk combined. Mostly, their viewership comes from the enduring popularity of MapleStory and the success of the launch of MMO / Looter Shooter The First Descendant.

Korea’s live-streaming scene is exciting for brands looking to access the region. In particular, brands that can reach audiences through MOBA and MMORPG activations (attractive as live service games), or unique culturally-specific brand activations (e.g. through Mukbangs) are positioned to take advantage of this space. Additionally, as Korean games continue to expand to Western audiences, brands should consider partnerships with these titles. Stream Hatchet will be watching changes in Korea’s live-streaming space in the coming months.

To keep up to date with the latest regional live-streaming trends, follow Stream Hatchet: