At this point, it’s no secret that publishers are growing wary of launching new live service games due to a number of high profile shutdowns. In February 2023, a single week saw eight live service games shut down including Knockout City, Apex Legends Mobile, and Rumbleverse. This kicked off a wave of media attention, with numerous think pieces proclaiming the decline of the live service game genre across various live service revenue models.

But in the live-streaming space, the picture looks very different. Shutdowns may be attributed to a range of factors including R&D investment, staffing costs, marketing spend, platform support and so on. But the real death knell for any live service game is the inability to form a loyal community (or the dissolution of a previously existing community). In that sense, live streaming is crucial for understanding online support for a given game and predicting the size of the player base on launch day.

In this article, we’re looking at how live service games are performing on live-streaming platforms amidst the shutdowns, and how live streaming can help live service games manage their community.

A Closer Look at Concord’s Performance on Live Streaming

At this point, Concord’s shutdown hardly requires examination. Poor marketing, a non-F2P revenue model, and live service exhaustion are some of the most commonly cited reasons for Concord’s lackluster performance. But for our purposes here, it’s worth examining how Concord’s poor reception might have been anticipated based on its live-streaming performance leading up to launch day – and how we might apply these lessons to future game launches.

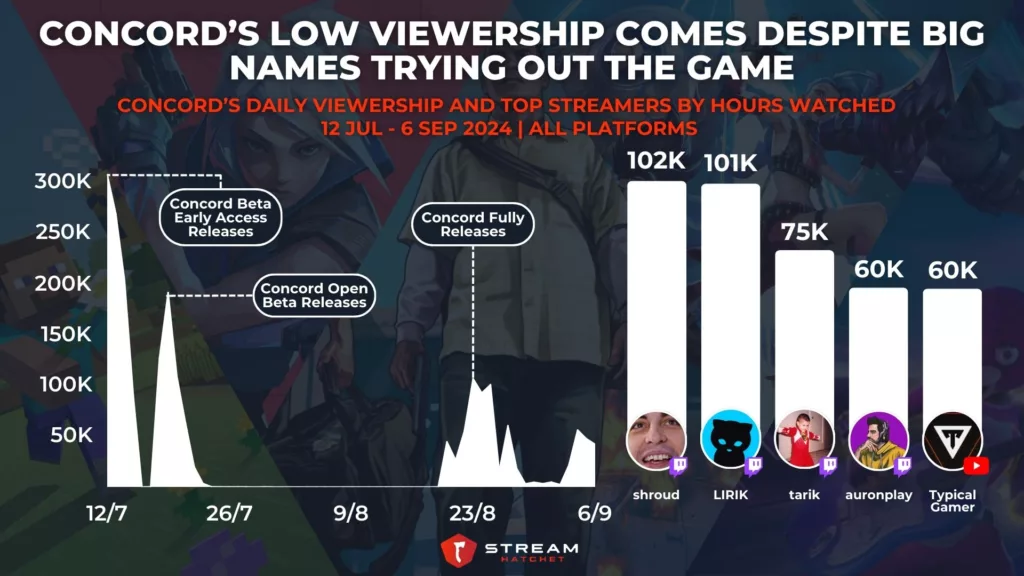

At first, Sony’s hero shooter received at least a smattering of curious onlookers. Concord hit its highest daily viewership of 308K hours watched when it first released into beta early access on the 12th of July. Big-name streamers like shroud, LIRIK, and tarik all logged on to check out the new hero shooter, despite minimal marketing on Sony’s behalf. But while streamers tried the game, viewers were left unimpressed. Daily viewership upon the beta’s proper launch sunk to 191K hours watched, and then sat at a disappointing 107K when the game fully launched in August. Despite positive critical praise, viewers didn’t gel with the game and streamers were inclined to return to their mainstay titles in the same genre: Overwatch, Apex Legends, and VALORANT. While pundits cited genre exhaustion, the recent success of Marvel Rivals suggests this isn’t solely the reason.

In the wake of Concord’s release, Sony (and PlayStation) revised their previously announced plans to focus on live service games. Two planned live service games were shut down (one of them being related to God of War), and the critical acclaim of their non-live service games like Ghosts of Tsushima and Astro Bot seem to be leading Sony away from live service games in the coming years. On the other hand, Helldivers 2 was a massive success in early 2024 and Sony are even adapting the IP into a film. On the whole, then, the story isn’t as simple as just “live service is over”. A more fair analysis is “live service is risky” – so for publishers still willing to take that risk, how can they leverage live streaming to promote their game and foster a community?

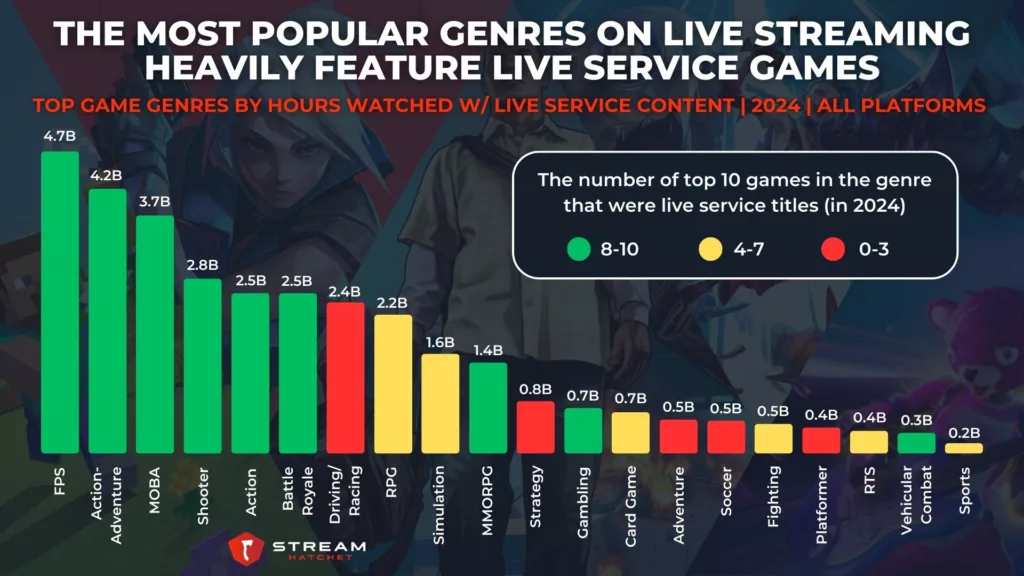

Live Service Games Remain Integral to Live Streaming Viewership

First off, it’s worth establishing that live service games are the primary way to reach live-streaming audiences. Looking at the top genres by hours watched in 2024, the top 6 all owed the vast majority of their viewership to live service titles (with 8 of their top 10 games being live service). This included FPS games, MOBAs, and Battle Royales which are almost exclusively live service genres. Only a few genres were able to avoid relying on live service games for their viewership, like Strategy and Adventure games – but these genres also had far lower watch times. For creative publishers, this might suggest space for live service innovation in these less competitive genres.

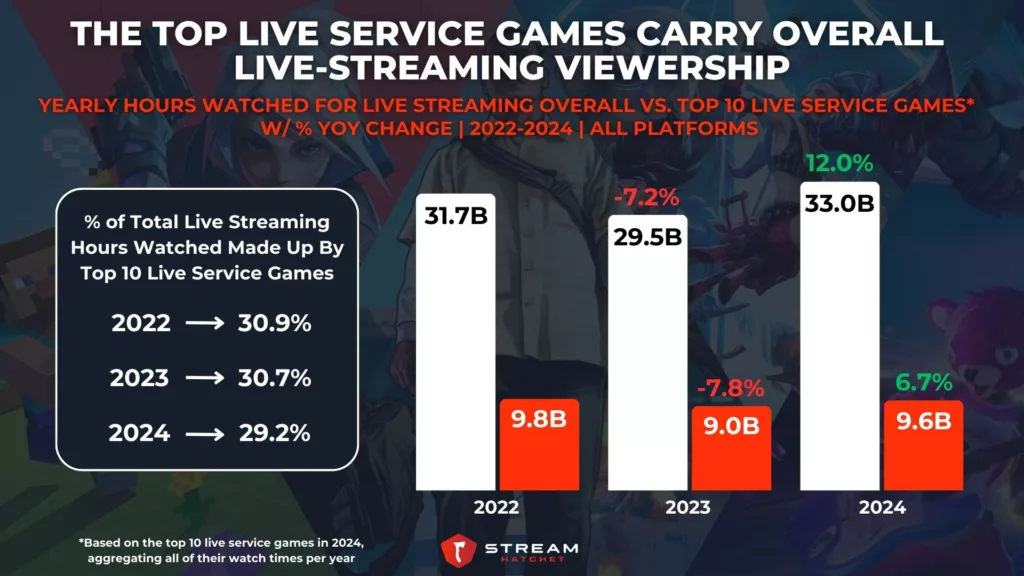

Taking a wider view of the topic, live service games are important for ALL live-streaming viewership. Over the past three years, the top 10 live service games alone have contributed roughly 30% of all watch time on live-streaming platforms (that total includes non-gaming watch time as well). Of course, the top 10 live service games also happen to be the top 10 games in general (Call of Duty: Warzone, League of Legends, Minecraft etc.). Live service games offer recurring content for streamers to build a loyal audience with, either through competitive esports content (Mobile Legends: Bang Bang) or more casual content (RP’ing on Grand Theft Auto V).

Although minor, live service games have slightly lost their importance in the last year. From 2023 to 2024, total live-streaming viewership increased by 12% while the top 10 live service games only increased by 6.7%. The reason for this relative dip isn’t exactly clear yet: This could be down to exciting new live service titles temporarily stealing the spotlight of established games (e.g. Helldivers 2, Marvel Rivals). On the other hand, it may be that non-live service games are rising to prominence (Elden Ring, Palworld). It will take more time to be sure, but for now it’s worth noting that the top live service games did still grow in viewership – live service games are far from over.

Live Service Games Provide The Greatest Marketing Exposure on Live Streaming

Due to their incredibly high watch time, live service games attract a lot of marketing interest online. Brands are eager to get their products featured in live service games through a variety of avenues. Sponsored esports tournaments, for example, put the brand’s name front-and-centre in exchange for event funding. Food & Drink, Tech, and Finance brands are the most common sponsors in these cases. But live service games also allow products to feature in situ with in-game loot thanks to their constant updates. Perhaps the most notorious examples of this strategy are Fortnite and Roblox in which brands actually compete for product placement opportunities (particularly Fashion and Lifestyle brands).

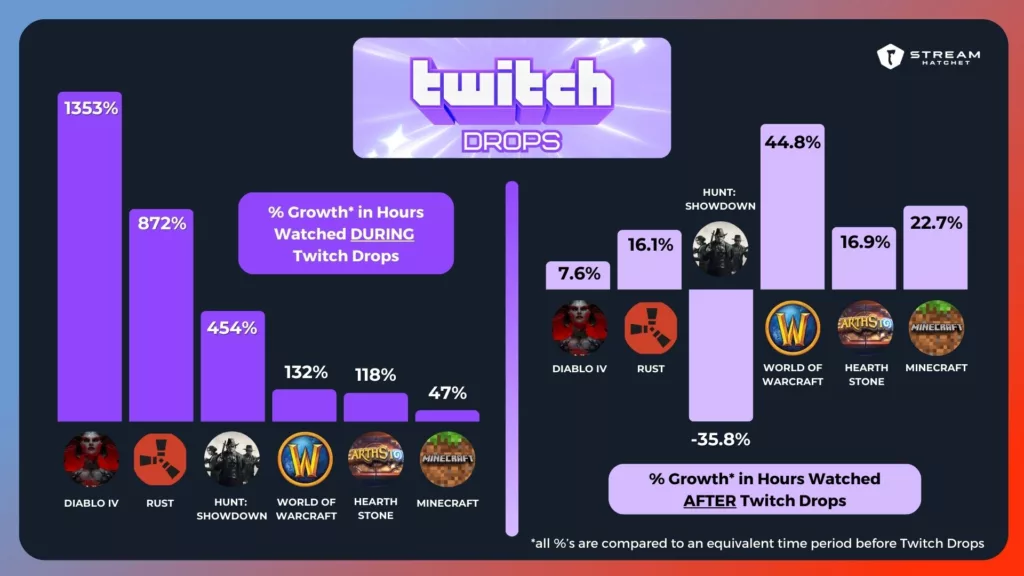

When it comes to live streaming specifically, live service games have a unique advantage over non-live service games for marketing: Live-streaming integrations. The most common example are Twitch Drops: Limited-time events in which viewers are rewarded with in-game items for tuning into streamers playing a specific title. For game publishers, Twitch Drops bring the community together and drive up viewership both during and after the event. For brands, of course, these live-streaming integrations provide a focused opportunity to reach the largest audience possible for a given game.

Publishers will continue to chase the potential profits of live service games; after all, estimates show that around 84% of total game revenue comes from live service titles. Entering the saturated genre is a high risk, high reward proposition for both publishers and brands. Brands willing to get in on the ground floor of a new live service game launch build deep trust with that game’s future fanbase – but they must be prepared for that game to shut down. Brands should therefore mitigate their risk of live service closures by using live-streaming data to monitor community engagement.

To keep up to date with the latest trends in genres on live-streaming platforms, follow Stream Hatchet: