Shooter games are more dominant than ever, yet the way that dominance expresses itself has shifted. Half a decade ago, the genre’s identity was defined by two pillars: Structured esports broadcasts and Battle Royales. But, as we recently covered in our Shooter Games report, Battle Royales are no longer the most popular Shooter game subgenre, with Extraction Shooters having taken the crown.

This evolution is unfolding most clearly on live-streaming: Shooter titles are now buoyed by server wipes, creator experiments, and community competitions that carry equal weight in shaping visibility. Streaming is a barometer for Shooter game audience’s preferences. In this article, we want to dive deeper into where Shooter game audiences are directing their attention by looking at the overlap between different Shooter game subgenres, streamers covering multiple franchises at once, and regional preferences based on esports.

TL;DR Takeaways by Stream Hatchet:

- Extraction Shooters are the current meta for popular shooters on live-streaming, kicked off by Escape from Tarkov’s early access release

- Shooter Game streamers are generally willing to try out other franchises, with audience overlaps as high as 51%

- Rainbow Six Siege is the dominant esports game by event viewership in both South America and Oceania

Big Numbers for Recent Shooter Game Releases Escape from Tarkov and Call of Duty: Black Ops 7

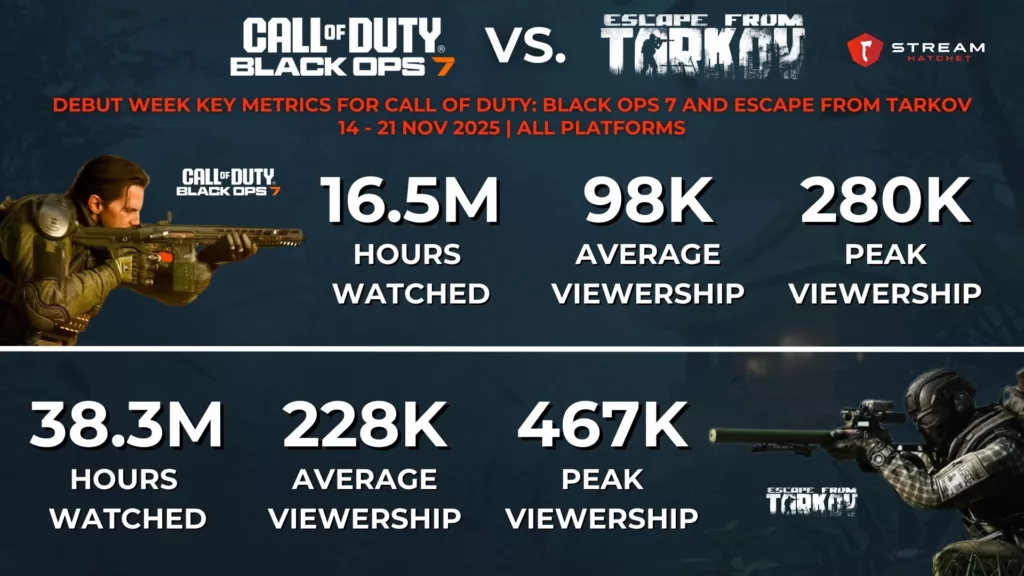

Before we go deep on macro-level trends, it’s worth starting out by looking at the release performance of two recent Shooter games: Call of Duty: Black Ops 7 and Escape from Tarkov. The difference in performance between these two titles speaks volumes about the modern Shooter game landscape.

Call of Duty: Black Ops 7 arrived with the certainty of a flagship release, drawing 16.5M hours watched and a peak viewership of 280K in its first week. Visibility was driven by coordinated activations such as early access sessions, creator partnerships, and platform-wide showcases across Twitch and YouTube. While this ensured immediate reach, viewing behavior followed familiar rhythms shaped by established Call of Duty creators; in other words, streamers already loyal to the franchise continued to prove their devotion. This is a strong performance from a cornerstone franchise, but it lacked the disruptive energy that defines cultural breakout moments.

Now compare that to the full release of Escape from Tarkov which brought in 38.3M hours watched and a peak viewership of 467K – that’s double the hours watched compared to Black Ops 7. Streaming activity centered on wipe cycles, progression races, and high-risk raids unfolding in real time, where each decision carried visible consequence. Escape from Tarkov’s phenomenal success, even when compared with veteran franchises is the result of its long early access period and now devoted fanbase. As the herald of Extraction Shooter popularity, many modern games like ARC Raiders also owe their current success to Escape from Tarkov.

The Streaming Community Embraces Variety Among Shooter Games and Subgenres

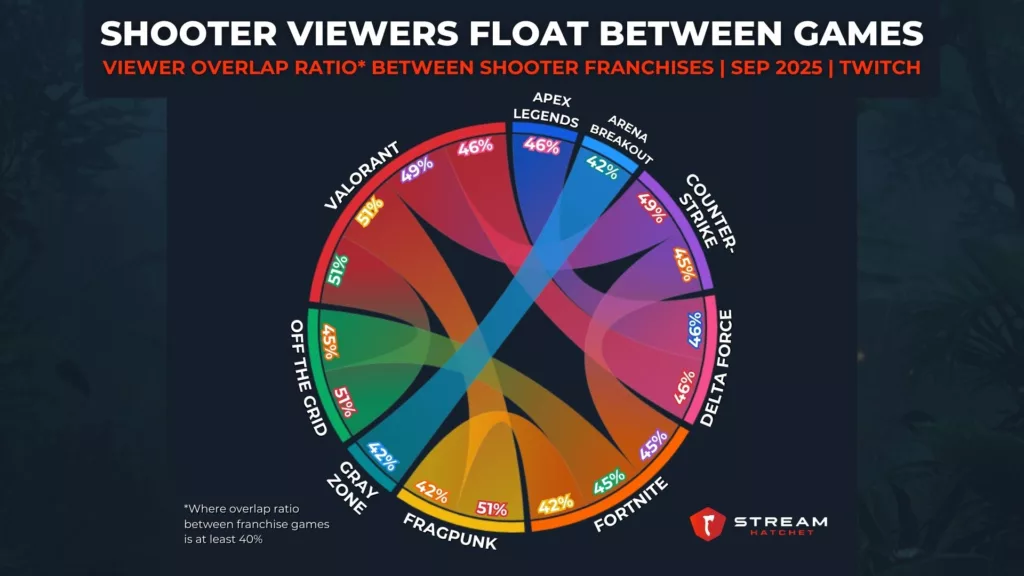

Part of the reason Escape from Tarkov was able to break into the Shooter game scene is the general fluidity of the genre’s audiences. Unlike, say, MOBA audiences who are very “sticky” (they’ll generally play just a single title within the genre), Shooter game audiences have shown their willingness to try other games on live-streaming. In fact, as shown in the graphic above, audience overlap between Shooter game franchises often sits above 40% even for established titles. This overlap can be even higher for games within the same subgenre with Tactical Shooter mainstays VALORANT, Counter-Strike, and Delta Force sharing overlap rates above 45%.

However, this promiscuity isn’t subgenre dependent: There’s meaningful crossover into titles like FragPunk and Off The Grid as well, signalling curiosity beyond traditional subgenre frameworks. Take VALORANT and FragPunk which share a 51% audience overlap, most likely due to their similar aesthetics (compared to other Shooter games). There’s also a contingent of viewers actively seeking the next big hit by watching newer franchises, like the 42% overlap between the audiences for Arena Breakout and Gray Zone. Publishers with new Shooter titles should consider reaching out to these audiences first.

“Variety streamers” encourage this free-floating nature of Shooter game fans: Their willingness to rotate between Shooter franchises introduces viewers to unfamiliar titles through trusted voices. From a publisher and developer perspective, this behavior carries tangible impact: Variety creators often determine where early momentum forms, which mechanics gain visibility, and how launch strategies evolve for both short-term spikes and long-tail engagement.

Of the top 10 “variety streamers” who recorded more than 100K hours watched of Shooter games in 2024, 8 of them streamed from North America. This overwhelming majority underlines the role of North America as the primary ecosystem for generating awareness for new Shooter titles. Take summit1g, for example, who streamed 15 different Shooter games in 2024 and generated 23.2M hours watched. His rotation included major performances in Escape From Tarkov at 10.6M hours watched and smaller contributions from Counter-Strike and Black Ops 6 at 1.5M and 1.4M hours watched, respectively. Increasingly, viewers look to creators rather than publishers to navigate the expanding shooter landscape, such as with co-streamers for esports events.

Different Regions Stay Loyal To Fan Favourite Shooter Game Esports

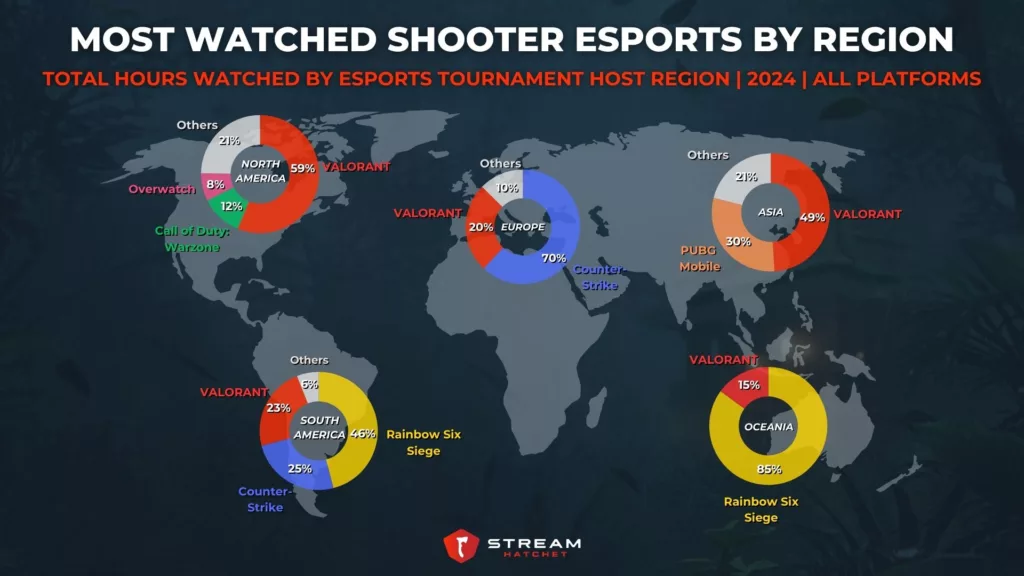

On the topic of esports, the competitive gaming scene is still crucial for defining which Shooter games are currently in the meta. Viewed this way, VALORANT comes out on top as it has maintained a significant share of hours watched across every global esports host region in 2024 thanks to a blend of structured leagues and organic community engagement. Counter-Strike, by comparison, relies heavily on the European market, where legacy fandoms and entrenched tournament circuits continue to anchor visibility.

Regional popularity doesn’t have to be a weakness though. Especially for emerging franchises, this regional boost can provide a way for these (mostly) live service games to get a foothold, achieve profitability, then expand outwards. In the Southern Hemisphere, for example, Rainbow Six Siege recorded the highest esports Shooter game viewership, suggesting strong regional appetite for methodical, tactical gameplay. PUBG Mobile stands apart as the only mobile title to feature in a regional Top 3, using the success of its popularity in Asia to compete on the same footing as non-mobile games.

_

The popularity of Shooter games on live streaming shows no signs of slowing. What will change, however, is the meta of which subgenres command attention. Today Extraction Shooters and co-op chaos reign supreme, but communities on Twitch and YouTube now function as an early signal system that helps publishers stay on top of emerging trends.

For developers and publishers, the next indicators to watch are creator experimentation, co-streaming patterns, and the performance of live-service pivots such as limited-time modes, Drops integrations, and extraction hybrids. By tracking where creators experiment and where audiences choose to linger, we gain real-time insight into the Shooter genre’s evolving identity.

To learn more about Shooter Games including the top subgenres and esports events, download your full Shooter Games Report now for free: